Starhill Global REIT has delivered a steadfast performance since

its public listing in 2005 through proactive lease management,

sourcing accretive acquisitions and creative asset enhancements.

Throughout, we maintained a sound financial standing, a strategy

that enabled us to survive in the face of challenging economic

cycles and deliver sustainable returns for our Unitholders.

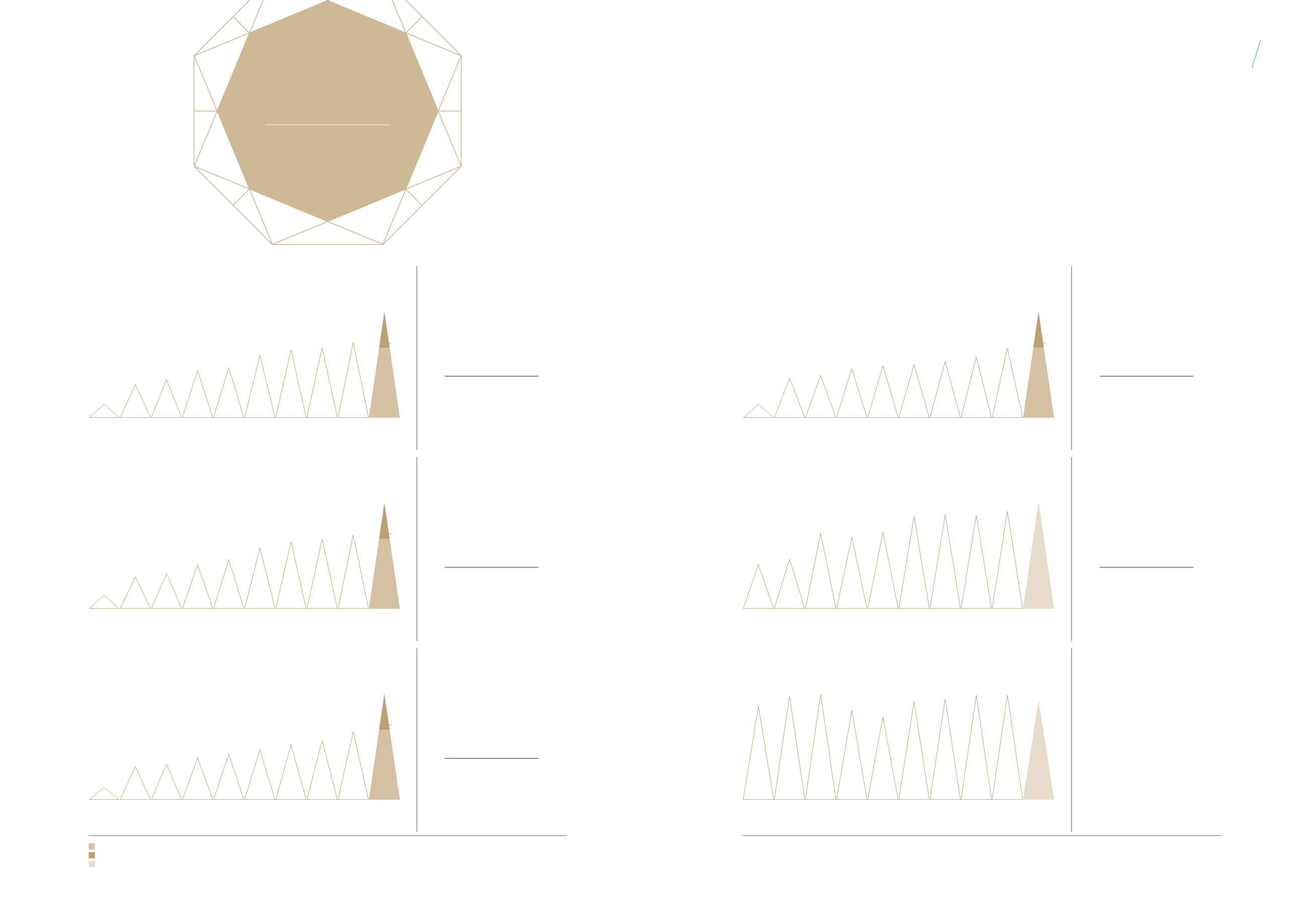

DPU

(3)

(cents)

Total Assets

(S$ million)

Occupancy Rate

(%)

FY

05

(1)

FY

06

FY

07

FY

08

FY

09

FY

10

FY

11

FY

12

FY

13

FY

14/15

0.79 2.90 3.10 3.58 3.80 3.90 4.12 4.39 5.00

5.05

Dec

05

Dec

06

Dec

07

Dec

08

Dec

09

Dec

10

Dec

11

Dec

12

Dec

13

Jun

15

1,353.5 1,525.8 2,277.6 2,163.4 2,312.3 2,786.6 2,839.1 2,820.2 2,943.2 3,193.4

Dec

05

Dec

06

Dec

07

Dec

08

Dec

09

Dec

10

Dec

11

Dec

12

Dec

13

Jun

15

97.3 99.2 99.6 96.6 95.4 98.2 98.7 99.4 99.4 98.2

7.60

¢

FY 2014/15

CAGR

(2) (3)

+7.2%

S$

3,193.4

m

JUNE 2015

CAGR +9.5%

98.2

%

JUNE 2015

Notes:

(1)

For the period from IPO in September 2005 to December 2005.

(2)

Excluded FY 2005 and the additional six months from January 2015 to June 2015 for FY 2014/15.

(3)

DPU from FY 2005 to 2Q FY 2009 have been restated to include the 963,724,106 rights units issued in August 2009.

Celebrating

10 Years

of Brilliance

Key Figures

for 10 Years

7.60

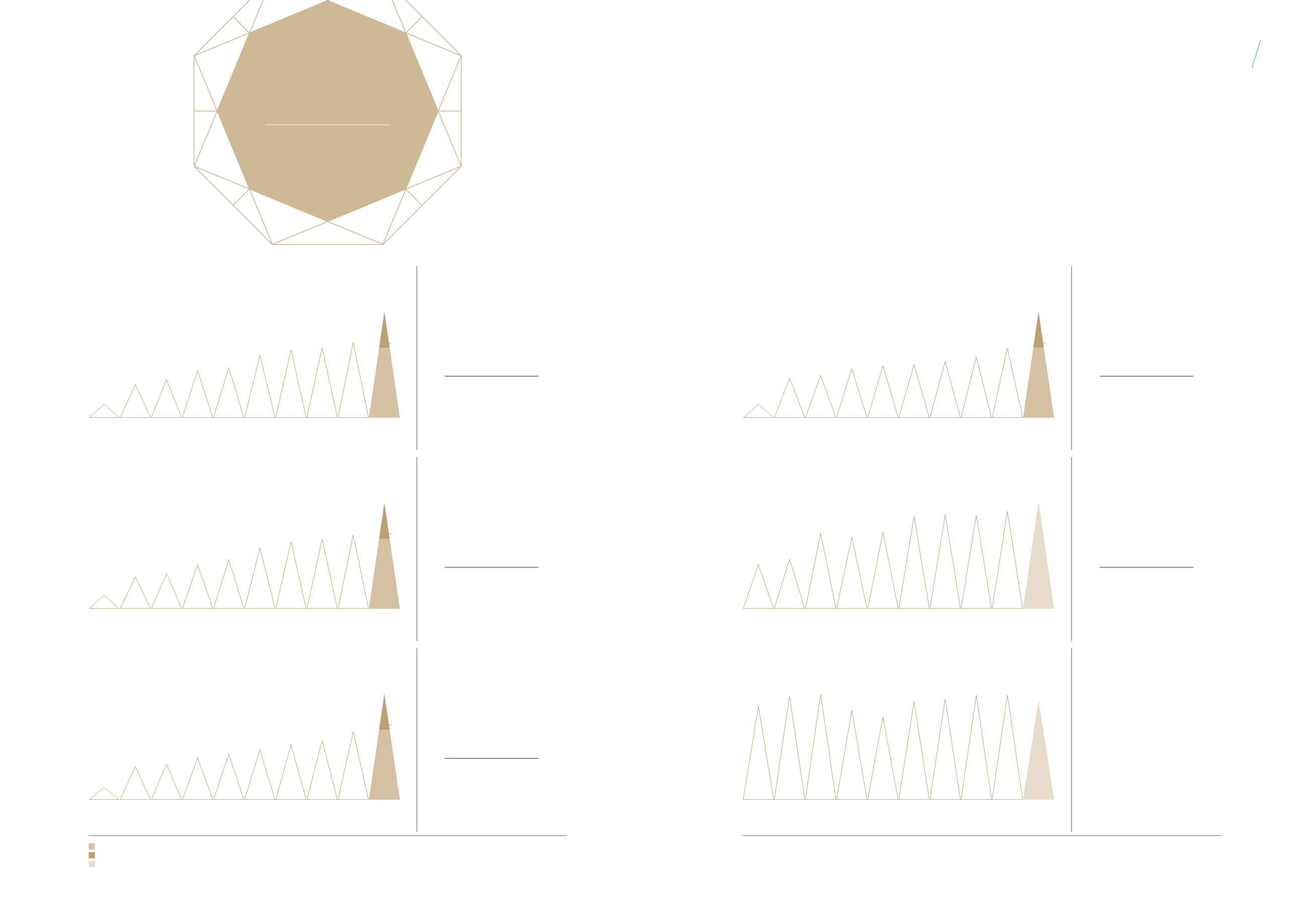

Gross Revenue

(S$ million)

Net Property Income

(S$ million)

Income Available for Distribution

(S$ million)

FY

05

(1)

FY

06

FY

07

FY

08

FY

09

FY

10

FY

11

FY

12

FY

13

FY

14/15

19.4 69.3 76.8 95.9 106.9 130.5 143.6 148.4 157.9

157.4

FY

05

(1)

FY

06

FY

07

FY

08

FY

09

FY

10

FY

11

FY

12

FY

13

FY

14/15

14.9 54.9 59.0 69.4 75.5 82.5 90.8 96.2 110.9

113.7

S$

294.8

m

FY 2014/15

CAGR

(2)

+10.2%

S$

237.6

m

FY 2014/15

CAGR

(2)

+10.8%

S$

171.6

m

FY 2014/15

CAGR

(2)

+9.5%

January 2014 – December 2014

January 2015 – June 2015

As at 30 June 2015

99.7

2.55

80.2

57.9

237.6

294.8

171.6

FY

05

(1)

FY

06

FY

07

FY

08

FY

09

FY

10

FY

11

FY

12

FY

13

FY

14/15

25.2 89.9 103.0 127.0 134.6 165.7 180.1 186.0 200.6

195.1

13

12