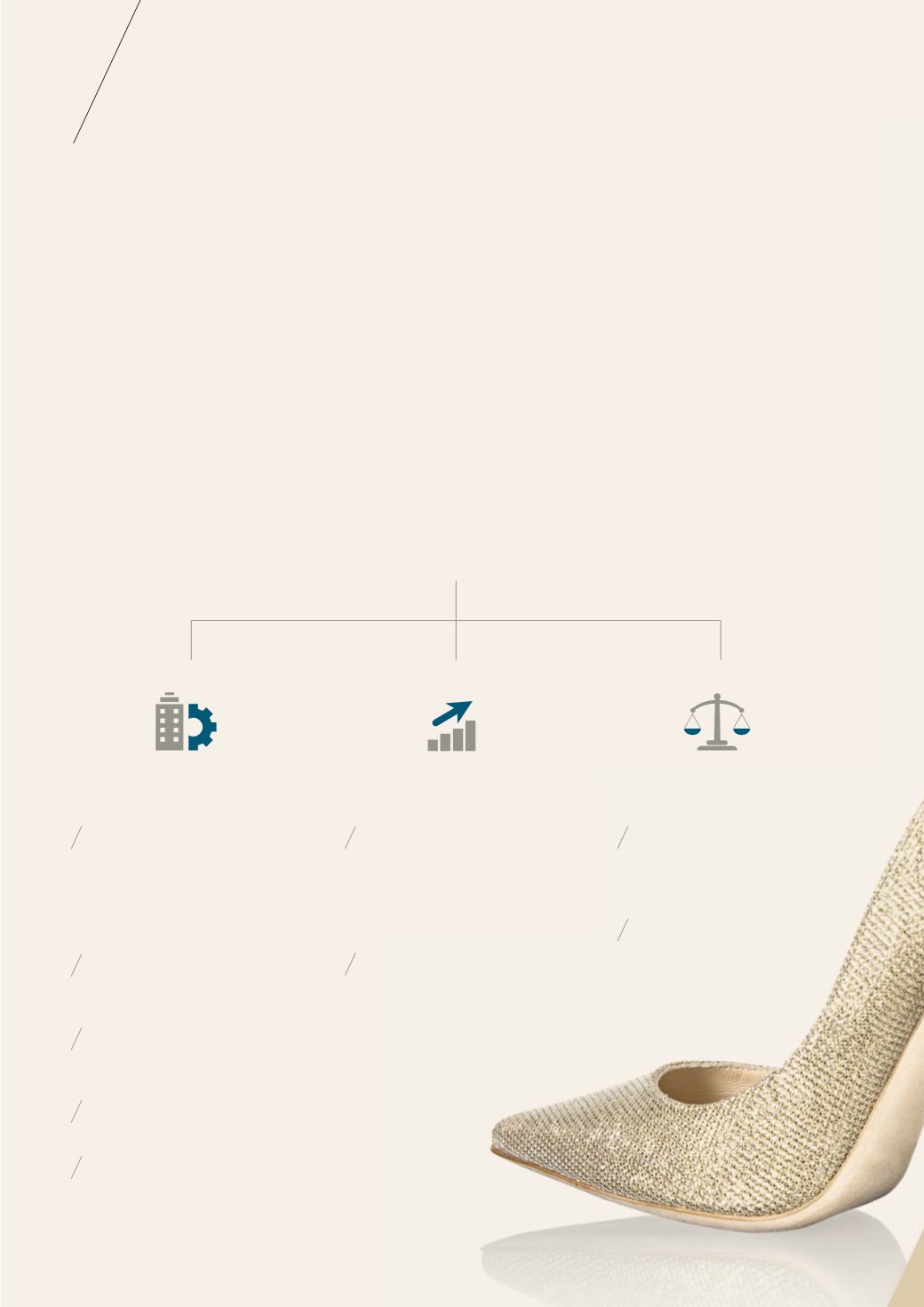

OUR

STRATEGY

Starhill Global REIT remains focused on sourcing

attractive property assets in Singapore and overseas,

while driving organic growth from its existing portfolio

through proactive leasing efforts and creative asset

enhancements, and maintaining a prudent capital

management approach.

ACTIVE ASSET

MANAGEMENT

ACQUISITION

GROWTH

CAPITAL

MANAGEMENT

STRATEGY

Investment portfolio

primarily comprising prime

real estate used mainly for

retail and/or office purposes

with strong fundamentals

and strategic locations

Long-term yield

accretive investments

made in Singapore and

overseas markets

Managing capital to

optimise Unitholders’

returns with a mix of

available capital sources

Employing appropriate

interest rate and

foreign exchange risk

management strategies

Balance of master tenancies

and long-term leases, coupled

with actively managed short-

to medium-term tenancies for

income stability with potential

rental upside

Driving organic growth from

existing portfolio through

proactive leasing efforts

Focusing on established mid-

to high-end retail tenant base

and optimising tenant mix

Unlocking value through

creative asset enhancements

Maintaining healthy and

sustainable occupancy rates

through economic cycles

2

STARHILL GLOBAL REIT ANNUAL REPORT FY 2016/17