SINGAPORE

PROPERTIES

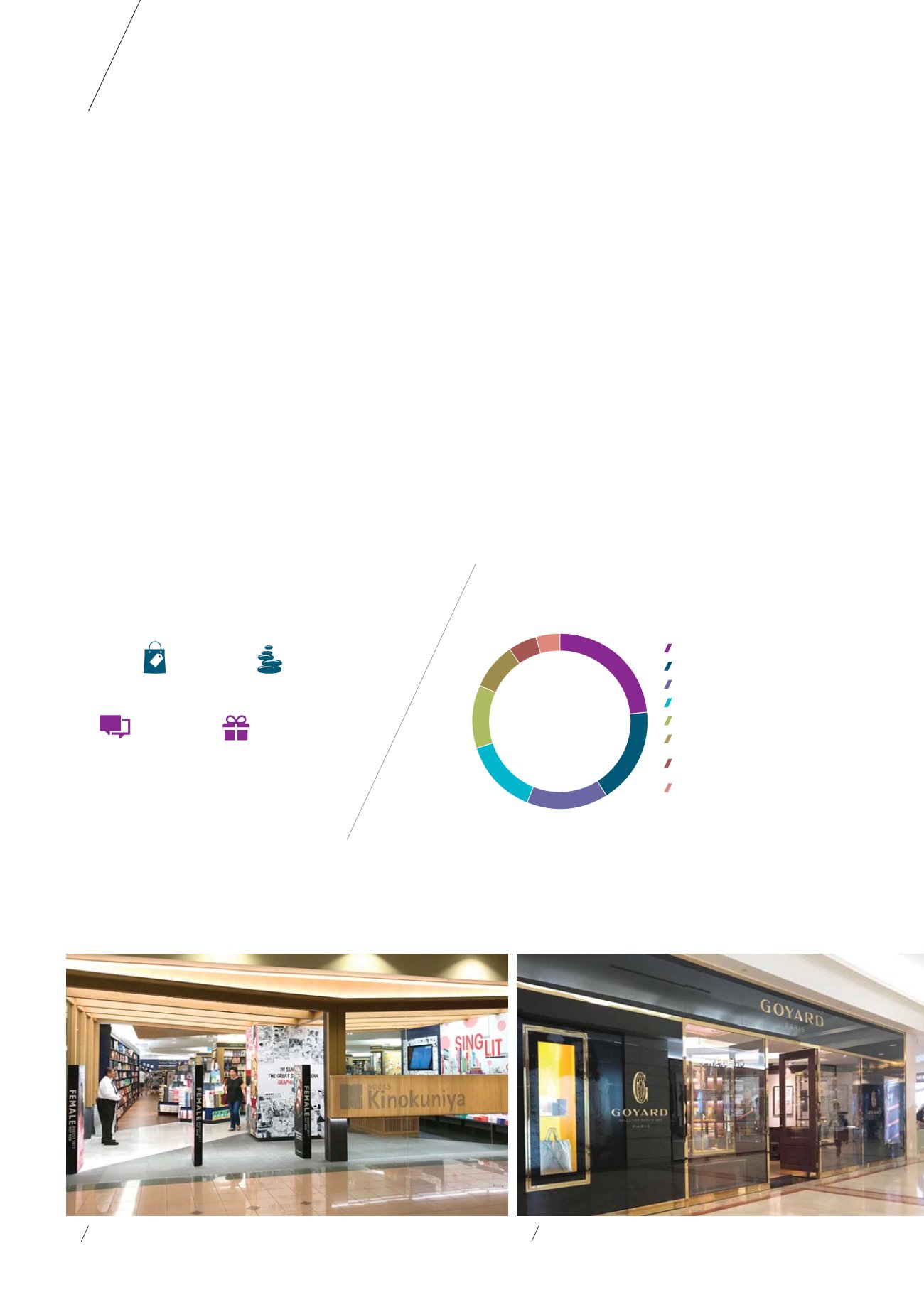

RETAIL TENANT MIX

The top contributors to Ngee Ann City

Property’s retail gross rent are Toshin

and DBS Bank. Toshin occupies all retail

areas in Ngee Ann City Property except

Level 5, which is actively managed by

the Manager. As at 30 June 2017, Toshin

accounted for 86.3% of the gross rent

of the Ngee Ann City Property (Retail).

Toshin is a wholly-owned subsidiary of

Toshin Development Co., Ltd., which is

in turn wholly-owned by Takashimaya

Company Limited, listed on the Tokyo

Stock Exchange. The Toshin lease,

which expires in 2025, has periodic rent

reviews which provide opportunities for

organic growth for Starhill Global REIT,

while ensuring income stability and

potentially mitigating fluctuations in

the retail market with a downside

rent protection. The last rent review

was concluded in June 2016 with

about 5.5% increase in base rent

for the three years commencing

8 June 2016.

The Manager actively manages the

beauty & wellness cluster on Level 5,

constantly rejuvenating the tenant mix

with complementary offerings.

OFFICE TENANT MIX

Fashion Retail, Petroleum-related and

Consultancy/Services are the top three

Books Kinokuniya at Ngee Ann City Property

Goyard boutique at Ngee Ann City Property

trade sectors contributing to the Ngee

Ann City Property’s office gross rent.

ADVERTISING AND PROMOTION

Ngee Ann City’s large outdoor

semicircular Civic Plaza is a popular

venue for many prestigious events

including concerts, fairs, product

launches, road shows, fashion

showcases, carnivals and lifestyle

launches. Ngee Ann City’s large event

hall, Takashimaya Square*, is also a

popular venue for regular bazaars and

events that draw throngs of shoppers.

RETAIL TRADEMIX

BY GROSS RENTAL CONTRIBUTION

(AS AT 30 JUN 2017)

0.5

%

GENERAL

TRADE

86.3

%

TOSHIN

10.7

%

BEAUTY &

WELLNESS

2.5

%

SERVICES

OFFICE TRADEMIX

BY GROSS RENTAL CONTRIBUTION

(AS AT 30 JUN 2017)

Fashion Retail

23.6%

Petroleum-related

17.6%

Consultancy/Services

15.0%

Beauty/Health

14.0%

Others

11.7%

Real Estate &

Property Services

8.6%

Banking &

Financial Services

5.2%

Aerospace

4.3%

* SGREIT does not own this strata.

38

STARHILL GLOBAL REIT ANNUAL REPORT FY 2016/17