96

STARHILL global reit ANNUAL REPORT FY 2016/17

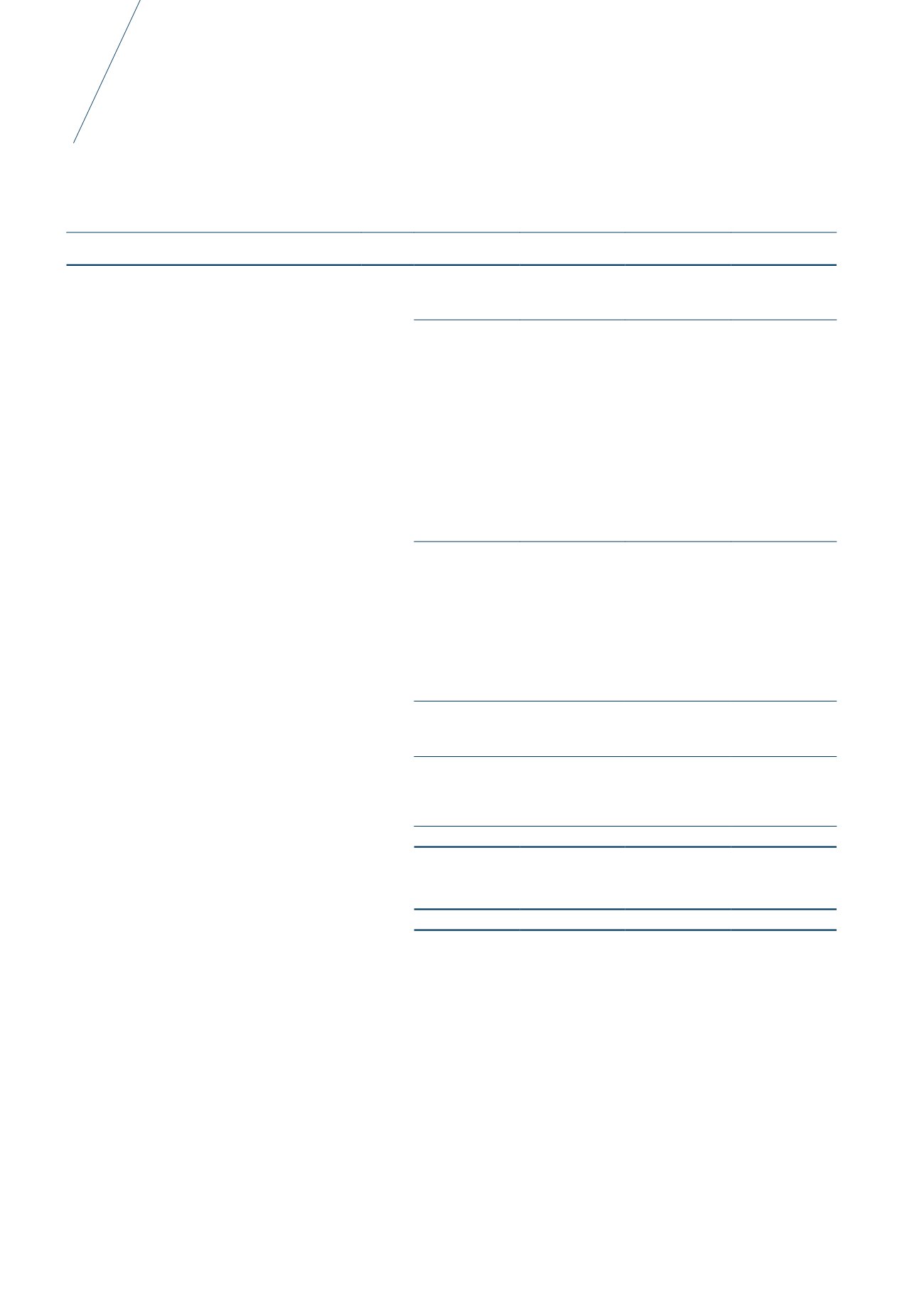

statementsof

total return

Year ended 30 June 2017

Group

Trust

Note

2017

$’000

2016

$’000

2017

$’000

2016

$’000

Gross revenue

15

216,364

219,679

134,480

134,251

Property operating expenses

16

(49,476)

(49,357)

(27,518)

(27,576)

Net property income

166,888

170,322

106,962

106,675

Interest income from fixed deposits

and bank balances

1,089

914

369

48

Interest income from subsidiaries

–

–

5,806

5,621

Dividend income from subsidiaries

17

–

–

22,771

8,343

Fair value adjustment on security deposits

(20)

(106)

(53)

(404)

Management fees

18

(16,192)

(15,903)

(15,256)

(14,930)

Performance fees

18

–

–

–

–

Trust expenses

19

(3,542)

(3,463)

(2,758)

(3,173)

Finance expenses

20

(38,930)

(38,767)

(25,056)

(24,211)

109,293

112,997

92,785

77,969

Change in fair value of derivative instruments

1,425

(6,487)

107

(4,959)

Foreign exchange gain/(loss)

3,819

(11,610)

(5,802)

(4,043)

Change in fair value of investment properties

4

(16,321)

77,973

3,493

69,029

Gain/(Loss) on divestment of

investment properties

(1)

770

(87)

–

–

Impairment loss on investment in subsidiaries

6

–

–

(9,000)

(23,000)

Impairment loss on intangible asset

(2)

–

(11,214)

–

–

Total return for the year before tax

and distribution

98,986

161,572

81,583

114,996

Income tax

21

1,268

2,324

(405)

–

Total return for the year after tax,

before distribution

100,254

163,896

81,178

114,996

Non-tax deductible/(chargeable) items

and other adjustments

10,191

(47,394)

29,267

1,506

Income available for distribution

110,445

116,502

110,445

116,502

Earnings per unit (cents)

Basic

22

4.60

7.51

3.72

5.27

Diluted

22

4.60

7.51

3.72

5.27

Notes:

(1)

Represents the difference between the net proceeds (including directly attributable costs) from divestment and the carrying amount of Harajuku Secondo in May 2017

(2016: Roppongi Terzo in January 2016).

(2)

Represents the impairment loss on goodwill arising from acquisition of Top Sure Investment Limited recorded in June 2016 and determined based on the difference between

the carrying amount and the recoverable amount of Top Sure Investment Limited and its subsidiary.

The accompanying notes form an integral part of these financial statements.