Property

Portfolio Summary

DIVERSIFIED RETAIL AND

OFFICE PORTFOLIO

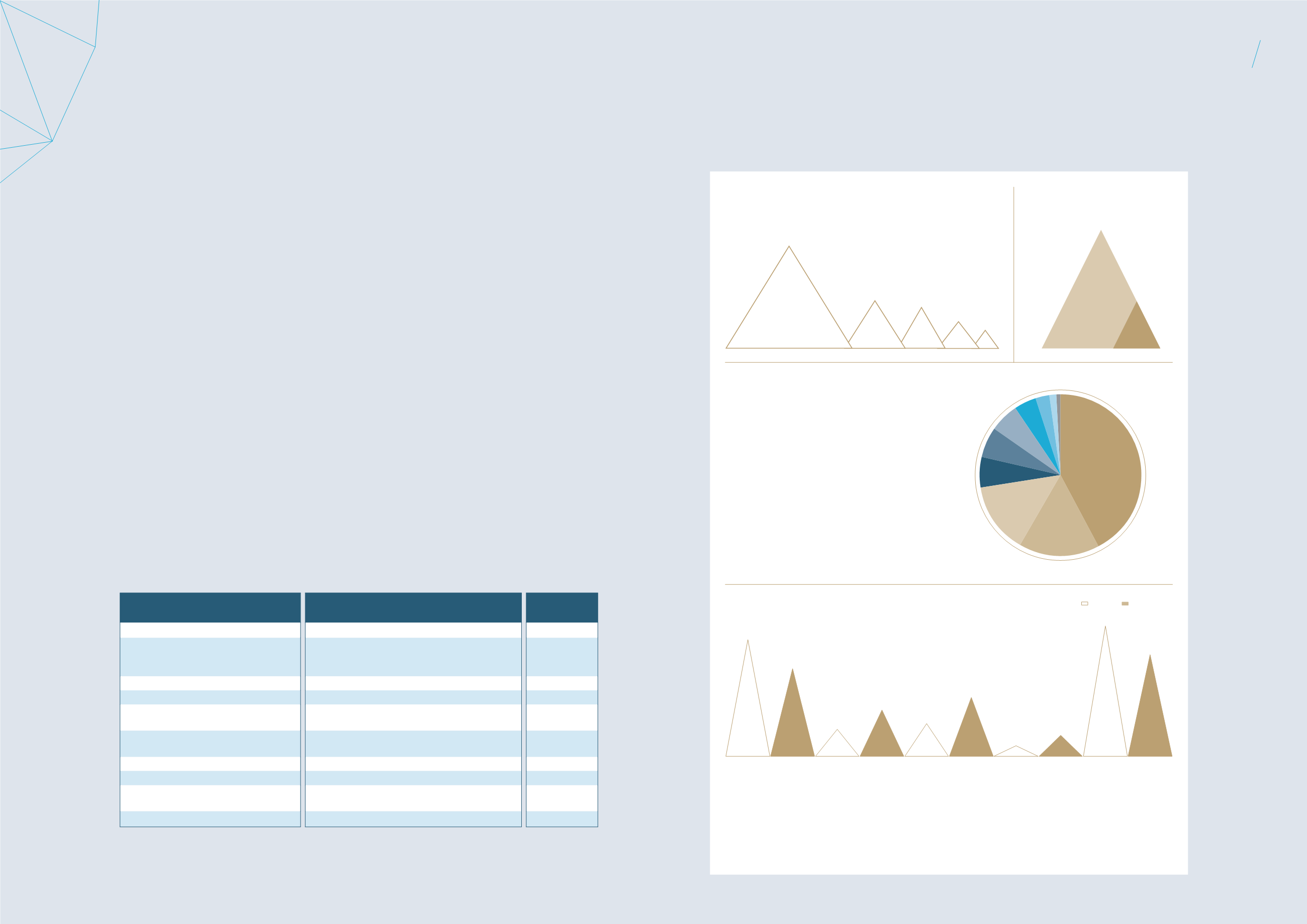

The Portfolio’s gross revenue is

diversified across Singapore 67.3%,

Malaysia 14.8%, Australia 11.0%,

China 4.7% and Japan 2.2% for

FY 2014/15. The retail and office

components contributed 86.4%

and 13.6% to the Portfolio’s

FY 2014/15 revenue respectively.

For June 2015, the top 10 tenants

of the Portfolio contributed 53.7%

of the Portfolio’s gross rent. The

top four tenants were Toshin

Development Singapore Pte. Ltd.

(Toshin), YTL Group, Myer Pty

Ltd and David Jones Limited,

Starhill Global REIT’s current portfolio comprises 13 prime

properties (Portfolio) in Singapore, Australia, Malaysia, China and

Japan. These comprise interests in Wisma Atria and Ngee Ann City

on Orchard Road in Singapore; Myer Centre Adelaide, David Jones

Building and Plaza Arcade in Australia; Starhill Gallery and Lot 10

Property in Kuala Lumpur, Malaysia; the Renhe Spring Zongbei

Property in Chengdu, China and five properties in Tokyo, Japan.

accounting for 19.2%, 14.1%, 5.9%

and 4.2% of the Portfolio’s gross

rent respectively. No other tenant

accounted for more than 3% of the

Portfolio’s gross rent.

RESILIENT LEASE PROFILE

The Portfolio has several master

leases and long-term leases,

providing rental income stability.

Toshin’s lease at Ngee Ann

City Property until June 2025

incorporates a rent review every

three years, with the next review

due in June 2016. The first rent

review for the renewed lease in

June 2013 was conducted at the

point of renewal, increasing the

base rent by 6.7%. The Malaysia

Properties are under master leases

with Katagreen Development Sdn

Bhd for a fixed term of 3+3 years

commencing on 28 June 2010. The

landlord and the master tenant have

a put and call option respectively to

extend the lease for a further three

years upon expiry of the second

term in June 2016. The David Jones

Building in Perth, Australia has a

long-term lease expiring in 2032

with anchor tenant David Jones

Limited, with upward-only rent

reviews every three years. Myer

department store has a long-term

anchor tenant lease at the Myer

Centre Adelaide expiring in 2032

TOP 10 TENANTS

Tenant Name

Property

% of Portfolio

Gross Rent

(1) (2)

Toshin Development Singapore Pte. Ltd.

Ngee Ann City Property, Singapore

19.2%

YTL Group

(3)

Ngee Ann City Property &

Wisma Atria Property, Singapore

Starhill Gallery & Lot 10 Property, Malaysia

14.1%

Myer Pty Ltd

Myer Centre Adelaide, Australia

5.9%

David Jones Limited

David Jones Building, Australia

4.2%

Cortina Watch Pte Ltd

Ngee Ann City Property &

Wisma Atria Property, Singapore

2.2%

Cotton On Group

Wisma Atria Property, Singapore,

Myer Centre Adelaide, Australia

2.0%

Wing Tai Retail Management Pte. Ltd.

Wisma Atria Property, Singapore

1.7%

BreadTalk Group

Wisma Atria Property, Singapore

1.7%

Coach Singapore Pte. Ltd.

Ngee Ann City Property &

Wisma Atria Property, Singapore

1.5%

Charles & Keith Group

Wisma Atria Property, Singapore

1.2%

Notes:

(1)

For the month of June 2015.

(2)

The total portfolio gross rent is based on the gross rent of all the properties including the Renhe Spring Zongbei Property.

(3)

Consists of Katagreen Development Sdn Bhd, YTL Singapore Pte. Ltd., YTL Starhill Global REIT Management Limited and YTL Starhill

Global Property Management Pte. Ltd..

Notes:

(1)

Portfolio lease expiry schedule includes Starhill Global REIT’s properties in Singapore, Australia, Malaysia and Japan but

excludes Renhe Spring Zongbei Property, China which operates as a department store with short-term concessionaire leases

running three to 12 months.

(2)

Lease expiry schedule based on committed leases as at 30 June 2015.

(3)

Includes the master tenant leases in Malaysia that enjoy fixed rental escalation and have an option to be renewed for a further

three-year term from June 2016.

(4)

Includes the Toshin master lease that expires in 2025 and the long-term leases with David Jones Limited and Myer Pty Ltd which

expire in 2032.

1

Master Tenancies & Long-Term Leases

42.3%

2 Fashion

16.2%

3 Office

14.2%

4 Jewellery & Watches

6.1%

5 F&B

6.0%

6 Beauty & Wellness

5.8%

7 Shoes & Accessories

4.5%

8 General Trade

2.7%

9 Services

1.5%

10 Others

0.7%

PORTFOLIO TRADE MIX

by gross rental contribution (for Jun 2015)

PORTFOLIO LEASE EXPIRY (AS AT 30 JUN 2015)

(1) (2)

(%)

1

Singapore

67.3%

2 Malaysia

14.8%

3 Australia

11.0%

4 China

4.7%

5 Japan

2.2%

GROSS REVENUE

BY COUNTRY

FY 2014/15

GROSS REVENUE

BY RETAIL AND OFFICE

FY 2014/15

Retail

86.4%

Office

13.6%

FY 2015/16

FY 2016/17

FY 2017/18

FY 2018/19

Beyond FY 2018/19

5 4 3

2

1

By NLA By Gross Rent

1098

7

6

5

4

3

2

1

36.7

(3)

27.6

(3)

8.7

14.8

10.5

18.8

3.1

6.8

41.0

(4)

32.0

(4)

35

34

STARHILL

GLOBAL

REIT

Annual

Report

FY 2014/15