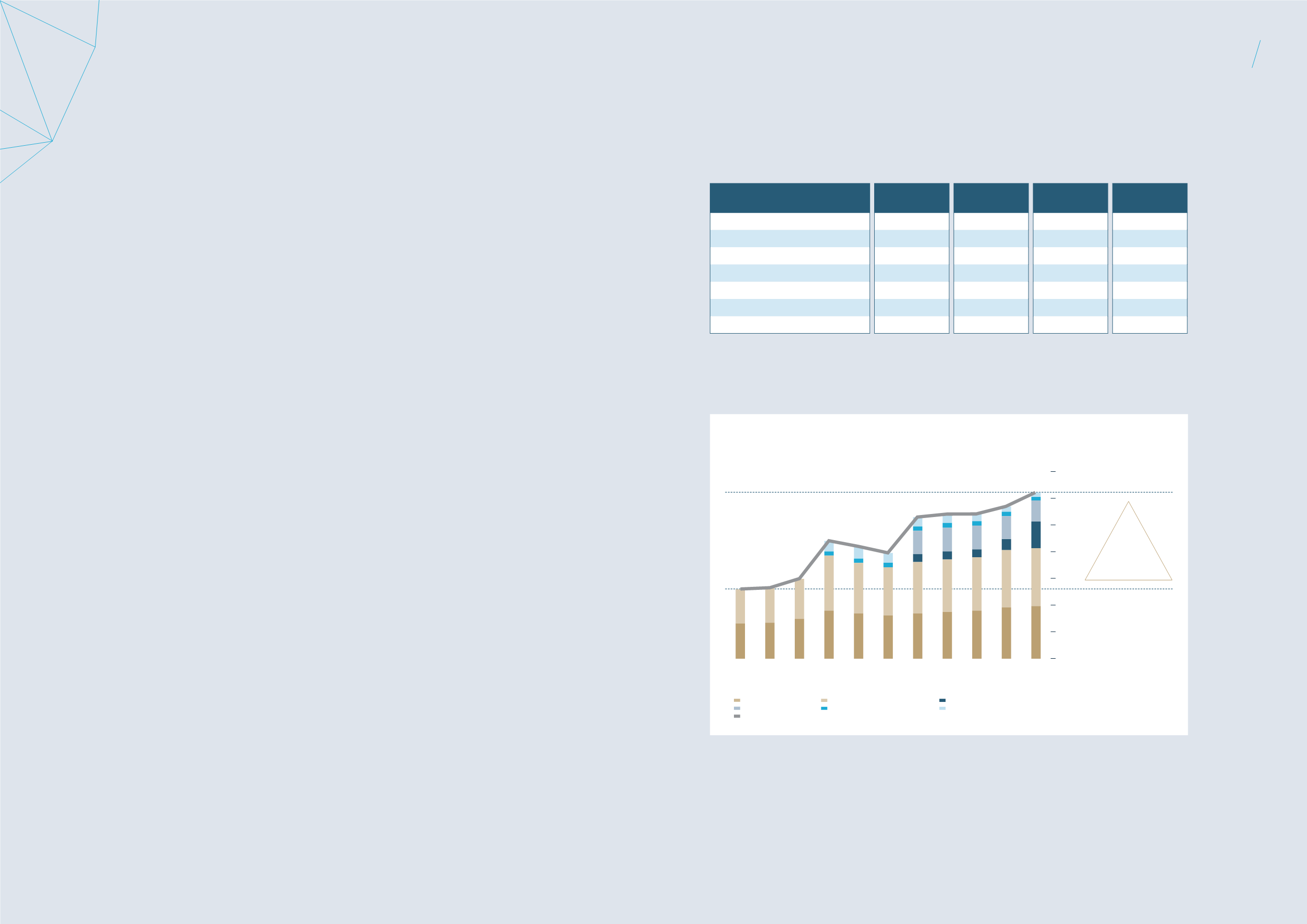

Property

Portfolio Summary

PORTFOLIO VALUATION

Description

30 Jun 2015

(S$ million)

31 Dec 2013

(S$ million)

Change

(S$ million)

Change

(%)

Wisma Atria Property

987.5

961.5

26.0

2.7%

Ngee Ann City Property

1,084.0

1,074.0

10.0

0.9%

Australia Properties

(1)

500.2

208.1

292.1

140.3%

Malaysia Properties

(2)

396.3

427.8

(31.5)

(7.4%)

Renhe Spring Zongbei Property

(3)

66.3

81.7

(15.4)

(18.8%)

Japan Properties

(4)

81.9

101.3

(19.4)

(19.2%)

3,116.2

2,854.4

261.8

9.2%

Notes:

(1)

Translated on 30 June 2015 at A$0.97:S$1 (31 December 2013: A$0.89:S$1).

(2)

Translated on 30 June 2015 at RM2.81:S$1 (31 December 2013: RM2.59:S$1).

(3)

Translated on 30 June 2015 at RMB4.61:S$1 (31 December 2013: RMB4.79:S$1).

(4)

Translated on 30 June 2015 at JPY90.94: S$1 (31 December 2013: JPY83.03:S$1).

which provides for an annual review.

Collectively, these master leases

and long-term leases accounted for

42.3% of the Portfolio’s gross rent

for June 2015.

The Manager actively manages the

remaining leases of the Portfolio,

which are on a short- to medium-

term basis. For the Singapore

Properties, besides the Toshin

master lease, earnings are derived

from retail leases in Wisma Atria

Property and Ngee Ann City

Level 5, as well as office leases

which are generally contracted

for a three-year period.

The Japan Properties generally

have tenancies with two- to five-

year lease terms while the specialty

retail units in the David Jones

Building and Plaza Arcade in Perth,

as well as the Myer Centre Adelaide

in Adelaide generally have one-

to five-year lease terms. The

Renhe Spring Zongbei Property in

Chengdu operates as a department

store with mostly short-term

concessionaire leases running

from three to 12 months.

As at 30 June 2015, the weighted

average lease term expiry (by NLA)

of the Portfolio is 6.8 years.

STRONG PERFORMANCE FOR

THE SINGAPORE PROPERTIES

The Singapore Properties consist

of both retail and office spaces,

which enjoy a combined occupancy

of 99.3% as at 30 June 2015. Prime

retail spaces including Wisma

Atria and Ngee Ann City enjoy

strong demand from international

retailers and new-to-market brands

looking to launch their products

in the region. The Wisma Atria

Property (Retail) enjoyed positive

rental reversions of 10.0% for leases

committed in FY 2014/15, as well

as centre sales of S$291.7 million

in FY 2014/15.

The office portfolio in the Singapore

Properties achieved a positive

rental reversion of 8.8% for leases

committed in FY 2014/15. The strong

performance of the office properties

can be attributed to their strategic

location, which appeals especially

to tenants from the fashion retail,

medical and services industries.

WEAKENING GROWTH

IN CHINA’S LUXURY

RETAIL MARKET

In China, GDP growth continued

to ease from 7.4% in 2014 to

7.0% in 1H 2015. Chengdu’s GDP

growth slowed down to 8.0% in

1H 2015, from 8.9% in 2014 but

still outpacing the national level.

As the ongoing austerity drive

which started in 2012 continues

to dampen the high-end luxury

market, Chengdu’s retail sales

growth slowed from 13.6% in

1H 2014 to 10.9% for 1H 2015. With

the influx of retail supply in recent

and future years, the retail market

in Chengdu continues to remain

challenging. The Renhe Spring

Zongbei Property will continue to

enhance its tenant mix to maintain

competitiveness in the market

and contain costs.

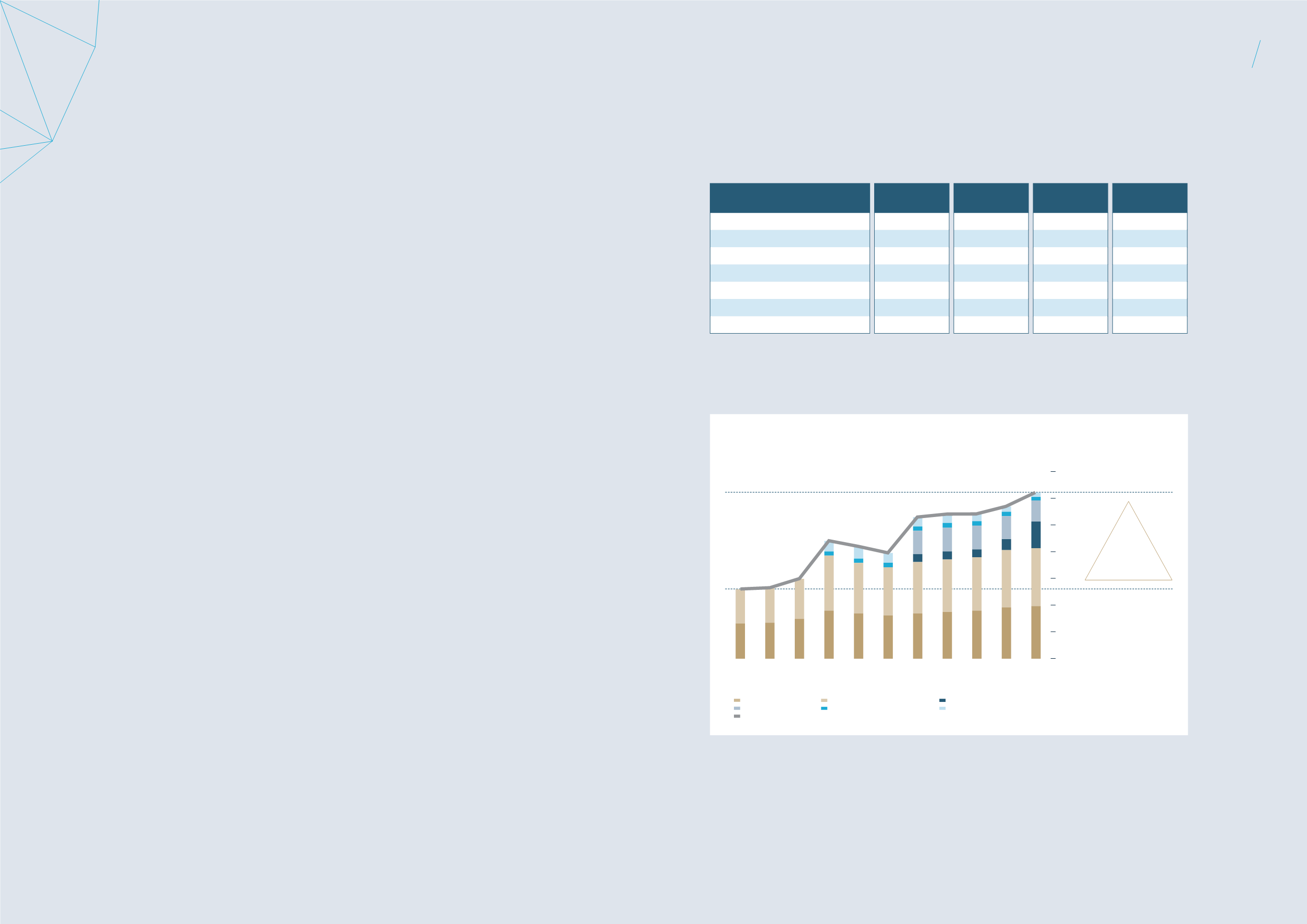

VALUATION

Starhill Global REIT’s property

portfolio was valued at

S$3,116.2 million as at 30 June 2015,

an increase of approximately

S$261.8 million compared to the

valuation as at 31 December 2013.

The increase was mainly driven

by the acquisition of the Myer

Centre Adelaide in Australia, offset

by negative foreign currency

movements and the drop in the

value of the Renhe Spring Zongbei

Property. Holon L in Tokyo, Japan

was divested in March 2014 as part

of our strategy to refine our portfolio.

As at 30 June 2015, the combined

valuation of the Wisma Atria

Property and the Ngee Ann

City Property increased to

S$2,071.5 million or a S$36.0 million

increase from 31 December 2013,

driven by higher rents secured for

the retail and office components.

The combined valuation of

the Australia Properties was

A$484.5 million (approximately

S$500.2 million), increasing

from that as at 31 December

2013 due to the acquisition of

Myer Centre Adelaide and lower

capitalisation rates for the David

Jones Building and Plaza Arcade

to reflect recent transacted yields

for retail properties. This increase

was partially offset by the weaker

Australian dollar in Singapore dollar

terms.

The Malaysia Properties were valued

at RM1,112.1 million (approximately

S$396.3 million) which saw an

increase in valuation in Malaysian

Ringgit terms from the valuation as

at 31 December 2013 mainly due to

lower property tax expenses. The

valuation of the Malaysia Properties

in Singapore dollar terms was

however affected by the weaker

Malaysian ringgit as compared

to 2013.

The valuation of Renhe Spring

Zongbei Property declined

RMB85.0 million (approximately

S$15.4 million) compared to

that as at 31 December 2013 due

to lower income assumed. The

Chinese Government launched a

series of austerity measures which

affected sales. The entry of new

retail malls in Chengdu has also

increased competition for tenants

and reduced shopper traffic at the

Renhe Spring Zongbei Property.

The Japan Properties were valued at

JPY7,448.0 million (approximately

S$81.9 million), a decrease of

JPY964.0 million in local currency

terms from the previous valuation

as at 31 December 2013 due to the

divestment of Holon L. Furthermore,

the depreciation of the Japanese Yen

caused the value of the remaining

five Japanese properties to decrease

8.7% as compared to that as at

31 December 2013 in Singapore dollar

terms. The Japan Properties are fully

hedged by Yen denominated loans.

S$1,813 million

uplift since IPO

Sep

05

Dec

05

Dec

06

Dec

07

Dec

08

Dec

09

Dec

10

Dec

11

Dec

12

Dec

13

Jun

15

Wisma Atria Property

Ngee Ann City Property

Australia Properties

Malaysia Properties

Renhe Spring Zongbei Property

Japan Properties

Total

3,500

3,000

2,500

2,000

1,500

1,000

500

0

PORTFOLIO VALUATION

(S$ million)

1,303 1,327

1,498

2,209 2,103

1,982

2,654 2,710 2,713

2,854

3,116

37

36

STARHILL

GLOBAL

REIT

Annual

Report

FY 2014/15