103

102

STARHILL

GLOBAL

REIT

Annual

Report

FY 2014/15

Notes to the

Financial Statements

Key unobservable inputs correspond to:

•

Capitalisation rates derived from specialised publications from the related markets and comparable transactions.

•

Discount rate, based on the risk-free rate for 10-year bonds issued by the government in the relevant market, adjusted for a

risk premium to reflect both the increased risk of investing in the asset class.

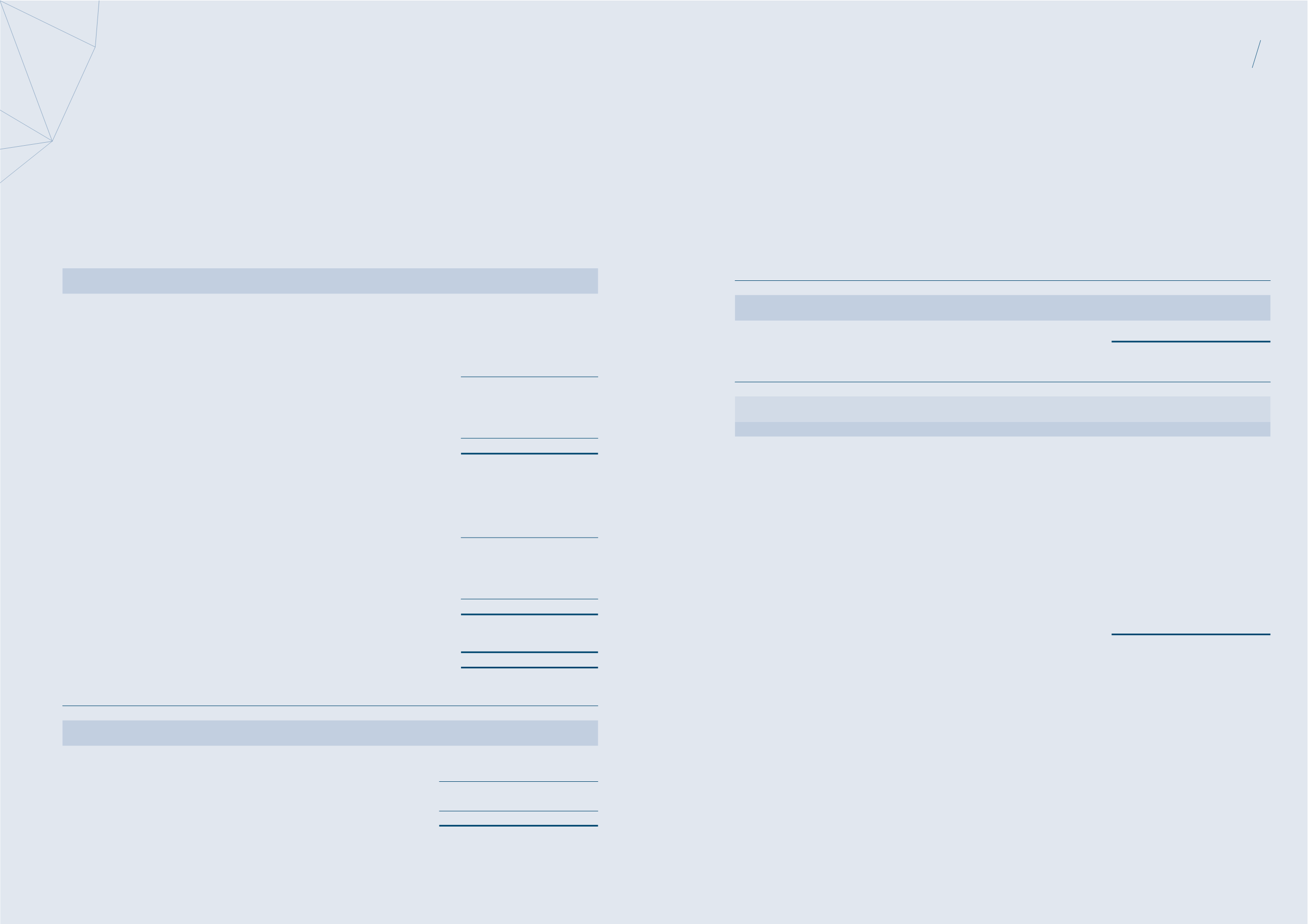

5. PLANT AND EQUIPMENT

Group

$’000

Trust

$’000

Cost:

At 1 January 2013

2,351

–

Additions

20

–

Disposal/write off

(105)

–

Translation differences

149

–

At 31 December 2013

2,415

–

Additions

798

790

Disposal/write-off

(2)

–

Translation differences

91

–

At 30 June 2015

3,302

790

Accumulated depreciation:

At 1 January 2013

(735)

–

Depreciation charge

(489)

–

Disposal/write off

99

–

Translation differences

(56)

–

At 31 December 2013

(1,181)

–

Depreciation charge

(1,006)

(367)

Disposal/write-off

2

–

Translation differences

(67)

–

At 30 June 2015

(2,252)

(367)

Carrying amount:

At 31 December 2013

1,234

–

At 30 June 2015

1,050

423

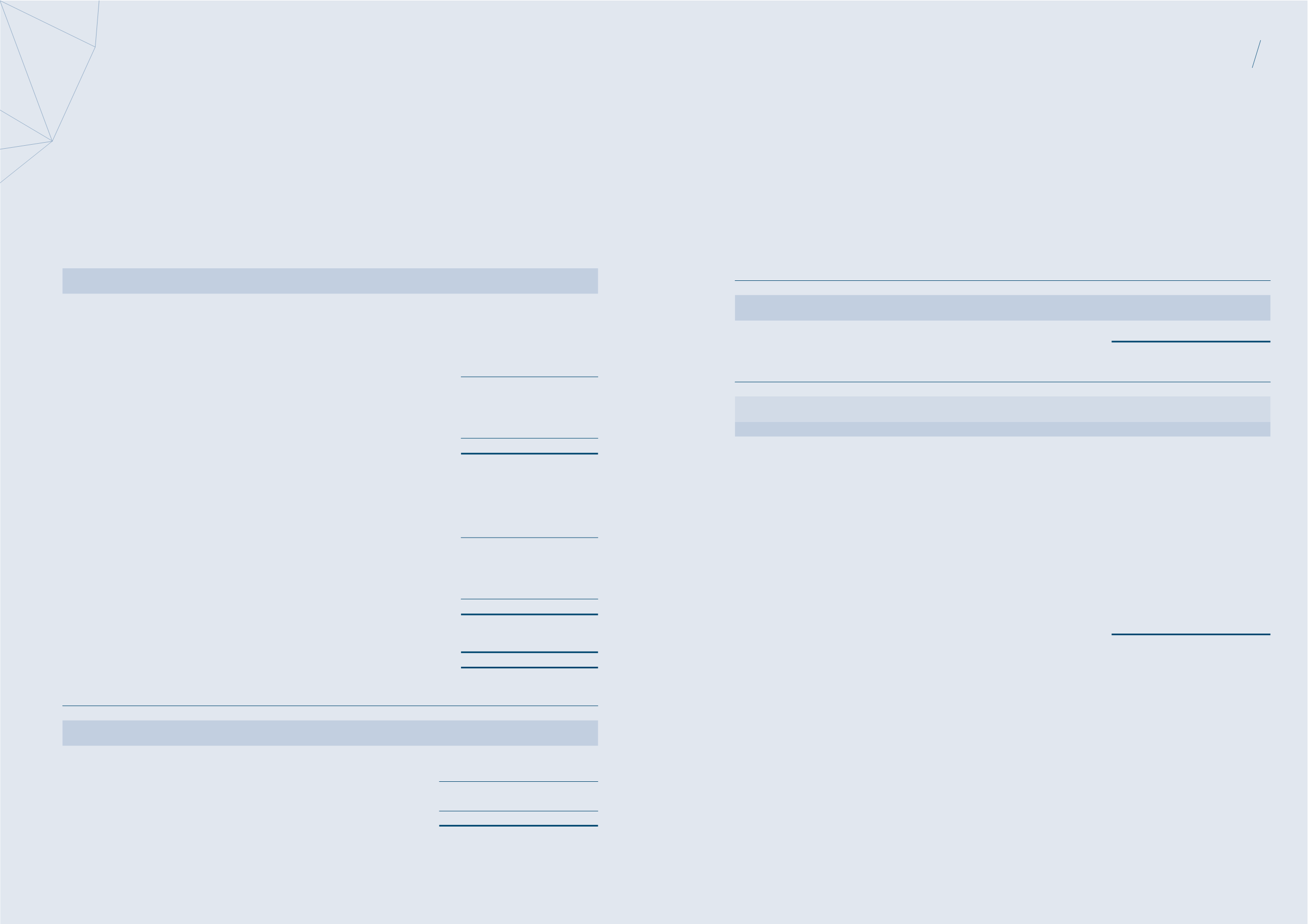

6. INTERESTS IN SUBSIDIARIES

Trust

30 June 2015

$’000

31 December 2013

$’000

Equity investments at cost

573,181

441,027

Advances to subsidiaries

197,036

199,721

770,217

640,748

Less: allowance for impairment loss

(67,000)

(67,000)

703,217

573,748

Advances to subsidiaries are unsecured and stated at cost less impairment loss. The advances form part of the Trust’s interests

in subsidiaries as settlement of these amounts is neither planned nor likely to occur in the foreseeable future.

The Manager has reassessed for impairment by comparing the recoverable amount of the Trust's interests in subsidiaries

against the Group’s investment in subsidiaries. The recoverable amount of the cash generating unit was estimated based on

its value in use, and using the discounted cash flow method. This involves the estimation and projection of an income stream

over a period at a rental growth rate indicative of market, and discounting the income stream with an internal rate of return.

The recoverable amount was estimated to approximate the net carrying amount of the Group’s interest in these subsidiaries,

and no impairment loss was recognised for the 18 months ended 30 June 2015 and 12 months ended 31 December 2013.

The movement in the allowance for impairment loss in respect of interests in subsidiaries during the period/year was as follows:

Trust

30 June 2015

$’000

31 December 2013

$’000

At beginning and end of period/year

(67,000)

(67,000)

Details of the subsidiaries are as follows:

Effective interest

Name of subsidiary

Country of

incorporation

30 June 2015

31 December 2013

%

%

Starhill Global REIT Japan SPC One Pte Ltd

(1)

Singapore

100

100

Starhill Global REIT Japan SPC Two Pte Ltd

(1)

Singapore

100

100

Starhill Global REIT MTN Pte Ltd

(1)

Singapore

100

100

SG REIT (M) Pte Ltd

(1)

Singapore

100

100

SG REIT (WA) Pte Ltd

(1)

Singapore

100

100

Starhill Global REIT One TMK

(2)

Japan

100

100

Starhill Global ML K.K.

(3)

Japan

100

100

Top Sure Investment Limited

(4)

Hong Kong

100

100

Renhe Spring Department Store Co., Ltd

(2)

China

100

100

SG REIT (WA) Trust

(2)

Australia

100

100

SG REIT (WA) Sub-Trust1

(2)

Australia

100

100

SG REIT (SA) Sub-Trust2

(2)

Australia

100

–

Ara Bintang Berhad

(2)

Malaysia

100

100

(1)

Audited by KPMG LLP

(2)

Audited by other member firms of KPMG International

(3)

Not required to be audited by the laws of the country of incorporation

(4)

Audited by other auditors

7.

INTANGIBLE ASSET

The intangible asset represents goodwill on acquisition of Top Sure Investment Limited (“Top Sure”) in August 2007. Top Sure

owns, through its wholly owned subsidiary, Renhe Spring Zongbei Property in China.

For the purpose of impairment testing, goodwill is allocated to the Group’s operations in China which represent the lowest

level within the Group at which the goodwill is monitored for internal management purposes. The recoverable amount of the

China cash-generating unit was based on its value in use. This involves the estimation and projection of an income stream over

a period at a rental growth rate indicative of market, and discounting the income stream with an internal rate of return. The

recoverable amount was estimated to approximate the net carrying amount of Top Sure’s interest in its subsidiary, and no

impairment loss was recognised for the 18 months ended 30 June 2015 and 12 months ended 31 December 2013. The movement

during the period was due to the retranslation of goodwill at the exchange rate at the reporting date.