85

84

STARHILL

GLOBAL

REIT

Annual

Report

FY 2014/15

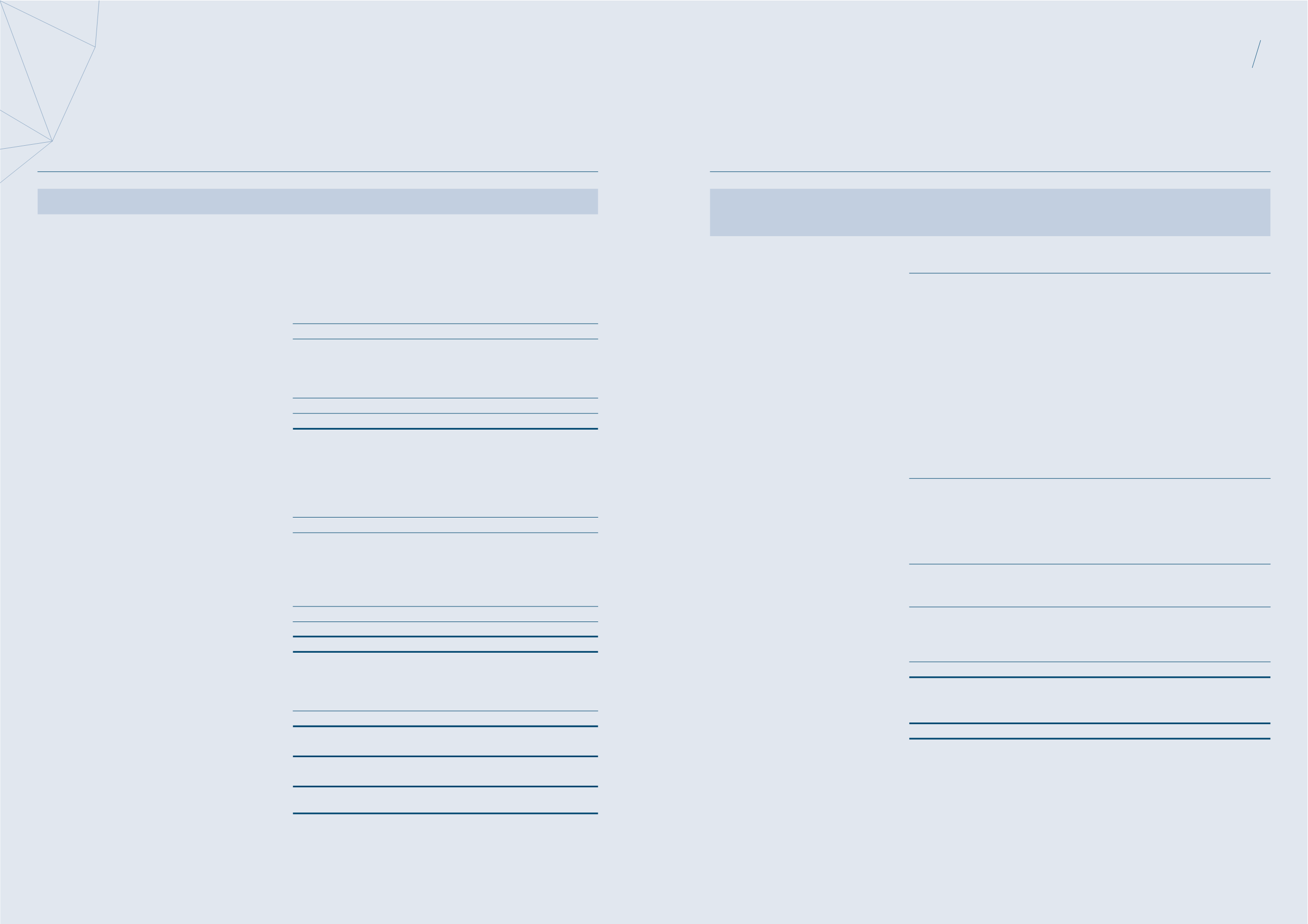

Balance

Sheets

As at 30 June 2015

Group

Trust

Note

30 June 2015

$’000

31 December 2013

$’000

30 June 2015

$’000

31 December 2013

$’000

Non-current assets

Investment properties

4

3,116,155

2,854,443

2,071,500

2,035,500

Plant and equipment

5

1,050

1,234

423

–

Interests in subsidiaries

6

–

–

703,217

573,748

Intangible asset

7

11,185

10,517

–

–

Derivative financial instruments

8

4,454

2,647

4,357

2,389

Trade and other receivables

9

3,674

6,053

2,344

3,533

3,136,518

2,874,894

2,781,841

2,615,170

Current assets

Derivative financial instruments

8

121

29

121

29

Trade and other receivables

9

5,184

10,192

4,853

12,514

Cash and cash equivalents

10

51,571

58,038

9,708

14,359

56,876

68,259

14,682

26,902

Total assets

3,193,394

2,943,153

2,796,523

2,642,072

Non-current liabilities

Trade and other payables

11

26,013

23,379

20,422

18,067

Derivative financial instruments

8

1,042

–

705

–

Deferred tax liabilities

12

14,884

18,552

–

–

Borrowings

13

983,249

792,330

639,692

577,634

1,025,188

834,261

660,819

595,701

Current liabilities

Trade and other payables

11

37,190

43,040

23,198

25,596

Derivative financial instruments

8

17

–

17

–

Income tax payable

2,208

2,136

–

–

Borrowings

13

146,000

53,572

146,000

52,433

185,415

98,748

169,215

78,029

Total liabilities

1,210,603

933,009

830,034

673,730

Net assets

1,982,791

2,010,144

1,966,489

1,968,342

Represented by:

Unitholders’ funds

14

1,982,791

1,989,764

1,966,489

1,947,962

Convertible preferred units (“CPU”)

15

–

20,380

–

20,380

1,982,791

2,010,144

1,966,489

1,968,342

Units in issue (’000)

16

2,181,204

2,153,218

2,181,204

2,153,218

Net asset value per unit ($) based on:

– Units issued at the end of the period/year

0.91

0.93

0.90

0.91

– Units issued at the end of the period/year,

assuming full conversion of CPU outstanding

0.91

0.92

0.90

0.90

The accompanying notes form an integral part of these financial statements.

The accompanying notes form an integral part of these financial statements.

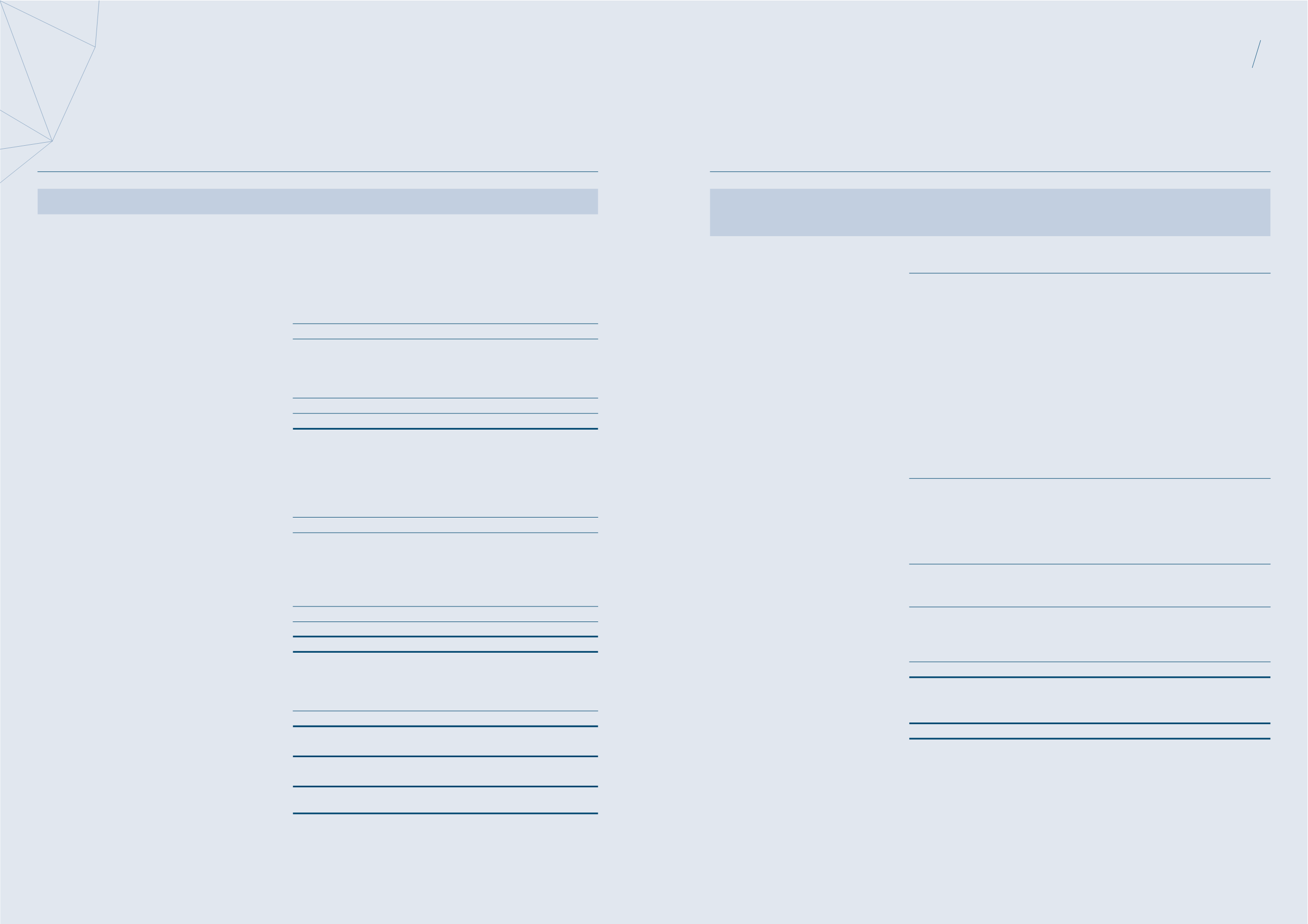

Statements of

Total Return

18 months ended 30 June 2015

Group

Trust

Note

18-month period

from 1 January 2014

to 30 June 2015

$’000

12-month period

from 1 January 2013

to 31 December 2013

$’000

18-month period

from 1 January 2014

to 30 June 2015

$’000

12-month period

from 1 January 2013

to 31 December 2013

$’000

Gross revenue

17

294,789

200,616

198,240

132,045

Property operating expenses

18

(57,160)

(42,760)

(40,725)

(29,402)

Net property income

237,629

157,856

157,515

102,643

Interest income from fixed deposits

and bank balances

1,551

541

330

72

Interest income from subsidiaries

–

–

6,639

6,482

Dividend income from subsidiaries 19

–

–

30,289

26,169

Fair value adjustment on

security deposits

(505)

38

(170)

233

Management fees

20

(22,399)

(14,216)

(20,792)

(13,088)

Performance fees

20

–

–

–

–

Trust expenses

21

(4,425)

(3,099)

(3,548)

(2,168)

Gain/(Loss) on divestment of

investment property

(1)

364

(300)

–

–

Finance expenses

22

(46,874)

(30,152)

(30,343)

(17,904)

165,341

110,668

139,920

102,439

Change in fair value of

derivative instruments

(479)

4,643

140

4,327

Unrealised foreign exchange loss

–

–

(14,010)

(8,023)

Change in fair value of

investment properties

4

9,120

137,528

36,000

131,841

Total return for the period/year

before tax and distribution

173,982

252,839

162,050

230,584

Income tax

23

559

(2,861)

–

–

Total return for the period/year

after tax, before distribution

174,541

249,978

162,050

230,584

Non-tax (chargeable)/deductible

items

(2,965)

(139,125)

9,526

(119,731)

Income available for distribution

171,576

110,853

171,576

110,853

Earnings per unit (cents)

Basic

24

8.05

12.06

7.47

11.12

Diluted

24

8.00

11.46

7.43

10.57

Note:

(1)

Represents the difference between the net proceeds (including directly attributable costs) from divestment and the carrying amount of Holon L divested in

March 2014 (2013: Roppongi Primo in February 2013).