87

86

STARHILL

GLOBAL

REIT

Annual

Report

FY 2014/15

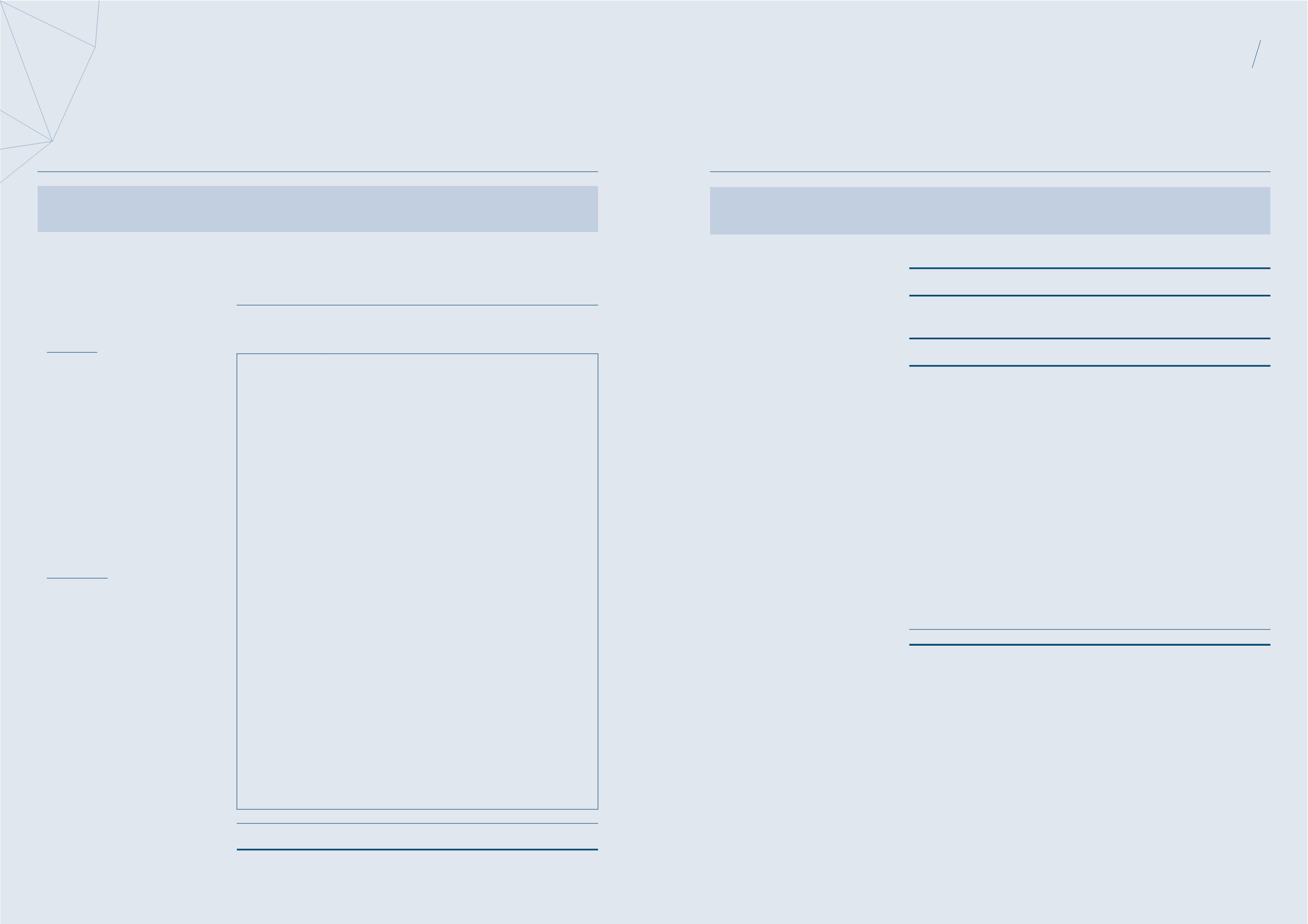

Distribution

Statements

18 months ended 30 June 2015

Group

Trust

18-month period

from 1 January 2014

to 30 June 2015

$’000

12-month period

from 1 January 2013

to 31 December 2013

$’000

18-month period

from 1 January 2014

to 30 June 2015

$’000

12-month period

from 1 January 2013

to 31 December 2013

$’000

Income available for distribution

at the beginning of the period/year

37,567

32,058

37,567

32,058

Total return after tax, before distribution

174,541

249,978

162,050

230,584

Net tax adjustments (Note A below)

(2,965)

(139,125)

9,526

(119,731)

Income available for distribution

209,143

142,911

209,143

142,911

Distributions for the period/year:

Unitholders

Distribution of 1.23 cents

(2012: 1.13 cents) per unit for the

period 1 October to 31 December 2013

(26,485)

(21,956)

(26,485)

(21,956)

Distribution of 1.24 cents

(2013: 1.37 cents) per unit for the

period 1 January to 31 March 2014

(26,700)

(26,619)

(26,700)

(26,619)

Distribution of 1.25 cents

(2013: 1.19 cents) per unit for the

period 1 April to 30 June 2014

(26,915)

(25,623)

(26,915)

(25,623)

Distribution of 1.27 cents

(2013: 1.21 cents) per unit for the

period 1 July to 30 September 2014

(27,346)

(26,054)

(27,346)

(26,054)

Distribution of 1.29 cents per unit for the

period 1 October to 31 December 2014

(27,777)

–

(27,777)

–

Distribution of 1.26 cents per unit for the

period 1 January to 31 March 2015

(27,131)

–

(27,131)

–

CPU holder(s)

Distribution of 1.2904 cents

(2012: 1.3280 cents) per CPU for the

period 1 October to 31 December 2013

(262)

(2,298)

(262)

(2,298)

Distribution of 1.2588 cents

(2013: 1.3074 cents) per CPU for the

period 1 January to 31 March 2014

(256)

(2,262)

(256)

(2,262)

Distribution of 1.2814 cents

(2013: 1.3207 cents) per CPU for the

period 1 April to 30 June 2014

(261)

(269)

(261)

(269)

Distribution of 1.3080 cents

(2013: 1.2955 cents) per CPU for the

period 1 July to 30 September 2014

(266)

(263)

(266)

(263)

Distribution of 1.2590 cents

per CPU for the period 1 October to

31 December 2014

(256)

–

(256)

–

Distribution of 1.2191 cents

per CPU for the period 1 January to

31 March 2015

(248)

–

(248)

–

(163,903)

(105,344)

(163,903)

(105,344)

Income available for distribution

at the end of the period/year

45,240

37,567

45,240

37,567

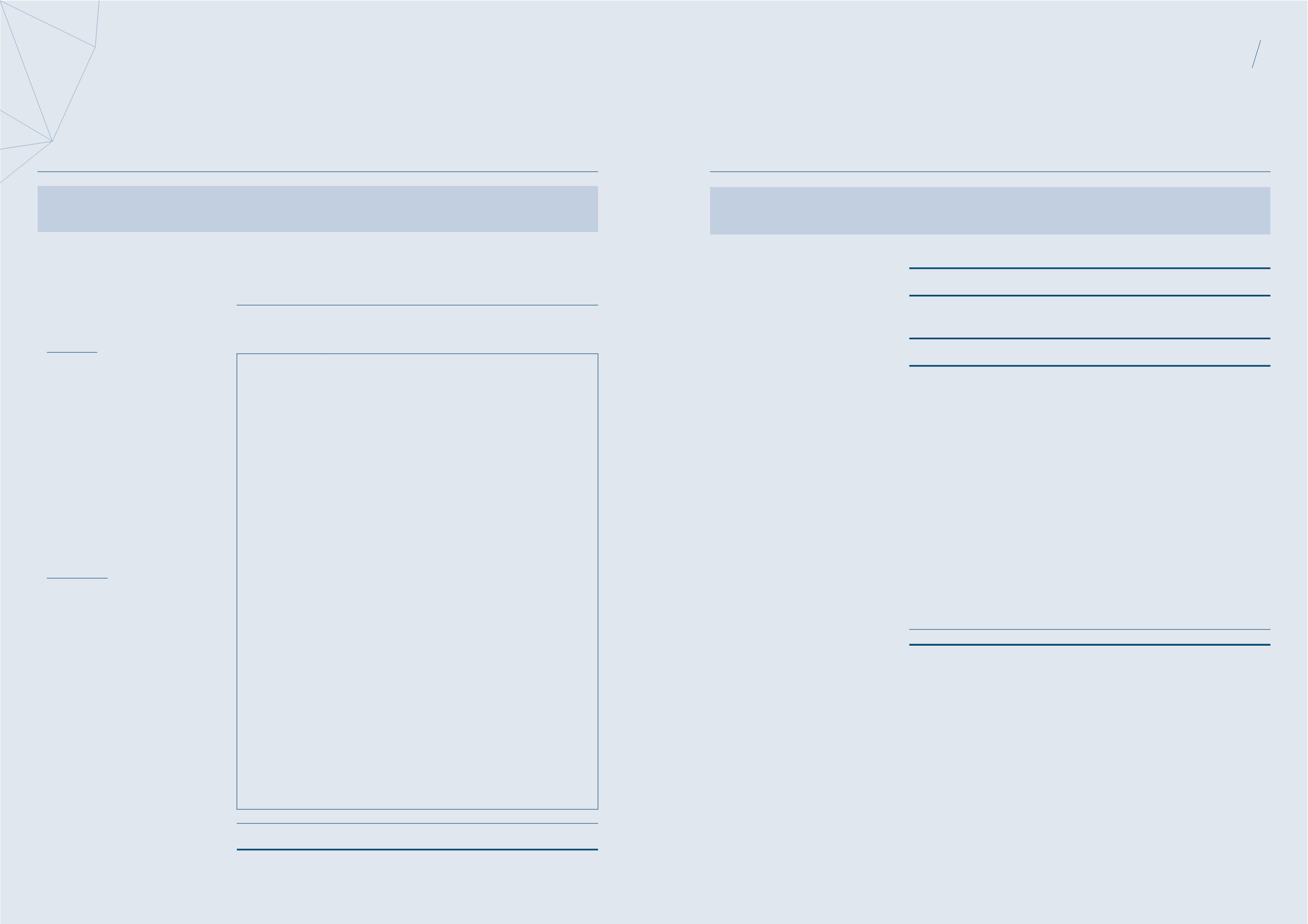

Group

Trust

18-month period

from 1 January 2014

to 30 June 2015

$’000

12-month period

from 1 January 2013

to 31 December 2013

$’000

18-month period

from 1 January 2014

to 30 June 2015

$’000

12-month period

from 1 January 2013

to 31 December 2013

$’000

Number of units at end of the

period/year (’000)

2,181,204

2,153,218

2,181,204

2,153,218

Number of CPU at end of the

period/year (’000)

–

20,335

–

20,335

Distribution per unit for the

period/year (cents)

7.60

5.00

7.60

5.00

Distribution per CPU for the

period/year (cents)

6.3263

5.2140

6.3263

5.2140

Note A – Net tax adjustments

Non-tax deductible/(chargeable) items:

– Finance costs

1,857

1,666

3,505

2,848

– Sinking fund contribution

2,712

1,548

2,712

1,548

– Depreciation

367

–

367

–

– Change in fair value of derivative

instruments

479

(4,643)

(140)

(4,327)

– Change in fair value of investment

properties

(9,120)

(137,528)

(36,000)

(131,841)

– Deferred tax

(4,349)

(1,324)

–

–

– Unrealised foreign exchange loss

–

–

14,010

8,023

– Fair value adjustment on

security deposits

505

(38)

170

(233)

– Other items

4,584

1,194

4,114

1,553

– Net overseas income not distributed to

the Trust, net of amount received

–

–

20,788

2,698

Net tax adjustments

(2,965)

(139,125)

9,526

(119,731)

The accompanying notes form an integral part of these financial statements.

The accompanying notes form an integral part of these financial statements.