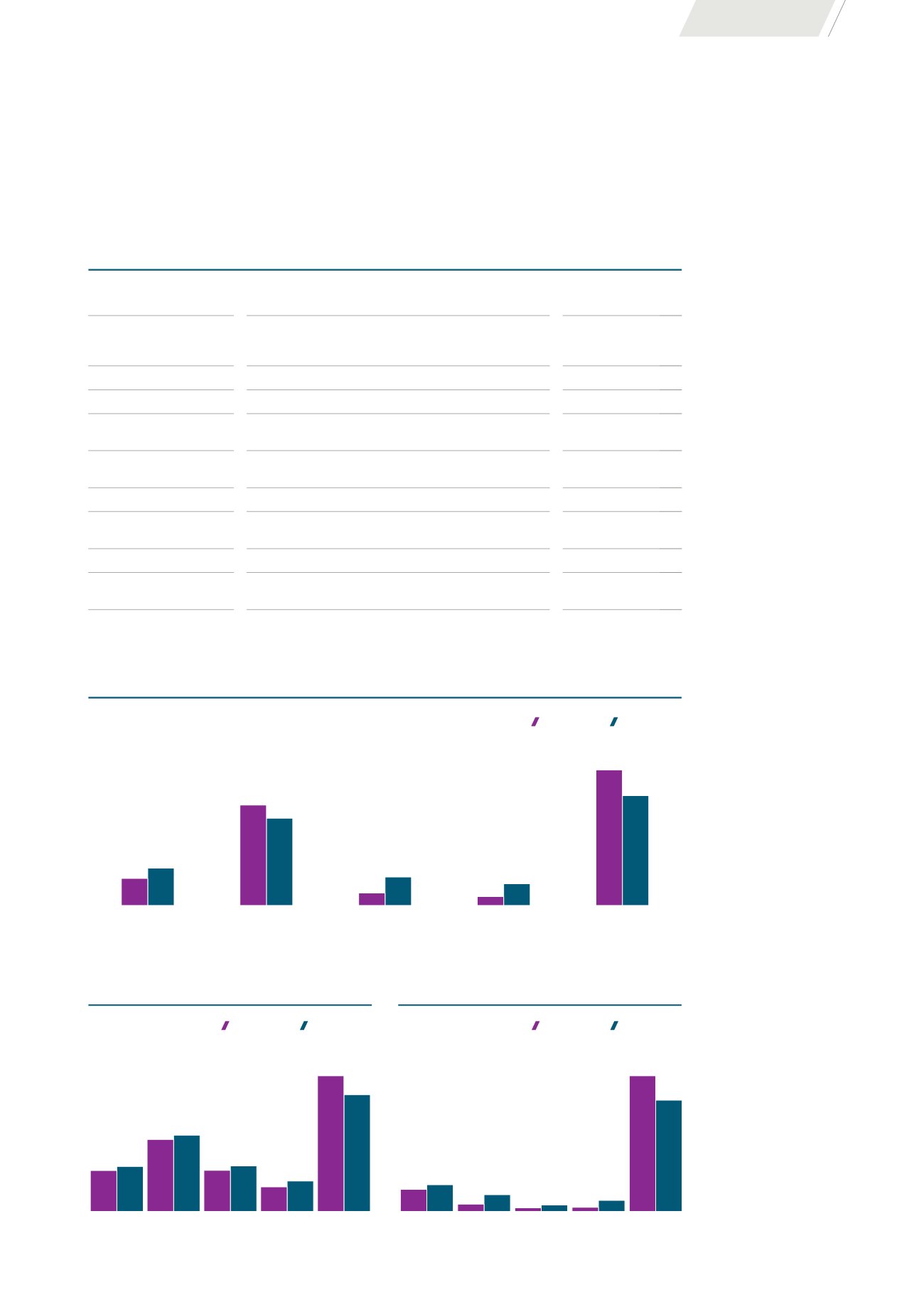

TOP 10 TENANTS

TENANT NAME

PROPERTY

% OF PORTFOLIO

GROSS RENT

(1) (2)

Toshin Development

Singapore Pte. Ltd.

Ngee Ann City Property, Singapore

20.8%

YTL Group

(3)

Ngee Ann City Property &

Wisma Atria Property, Singapore

Starhill Gallery & Lot 10 Property, Malaysia

14.0%

Myer Pty Ltd

Myer Centre Adelaide, Australia

6.8%

David Jones Limited David Jones Building, Australia

4.5%

Cortina Watch Pte Ltd Ngee Ann City Property &

Wisma Atria Property, Singapore

2.4%

Cotton On Group

Wisma Atria Property, Singapore,

Myer Centre Adelaide, Australia

2.2%

BreadTalk Group

Wisma Atria Property, Singapore

1.7%

Coach Singapore

Pte. Ltd.

Wisma Atria Property, Singapore

1.5%

Charles & Keith Group Wisma Atria Property, Singapore

1.3%

LVMH Group

Ngee Ann City Property &

Wisma Atria Property, Singapore

1.2%

Notes:

(1)

As at 30 June 2017.

(2)

The total portfolio gross rent

is based on the gross rent of

all the properties.

(3)

Consists of Katagreen

Development Sdn Bhd,

YTL Singapore Pte. Ltd.,

YTL Starhill Global REIT

Management Limited and

YTL Starhill Global Property

Management Pte. Ltd.

Notes:

(1)

Lease expiry schedule based

on committed leases as at

30 June 2017.

(2)

Includes the master tenant

leases in Malaysia that expire

in 2019.

(3)

Includes the Toshin master

lease that expires in 2025

and the long-term leases

in Australia and China.

PORTFOLIO LEASE EXPIRY

(1)

AS AT 30 JUN 2017 (%)

9.5

13.1

4.4

10.0

3.1

7.6

FY 2017/18

FY 2018/19

FY 2019/20

FY 2020/21

Beyond FY 2020/21

By NLA

By Gross Rent

AUSTRALIA PORTFOLIO LEASE EXPIRY

(1)

AS AT 30 JUN 2017 (%)

12.8

15.5

4.3

9.7

1.6

3.7

2.4

6.4

78.9

64.7

FY 2017/18 FY 2018/19 FY 2019/20 FY 2020/21

Beyond

FY 2020/21

By NLA

By Gross Rent

SINGAPORE PORTFOLIO LEASE EXPIRY

(1)

AS AT 30 JUN 2017 (%)

13.0

14.3

22.9

24.3

13.1

14.5

7.8

9.7

43.2

37.2

FY 2017/18 FY 2018/19 FY 2019/20 FY 2020/21

Beyond

FY 2020/21

By NLA

By Gross Rent

35.3

(2)

30.7

(2)

47.7

(3)

38.6

(3)

OPERATIONS REVIEW

29