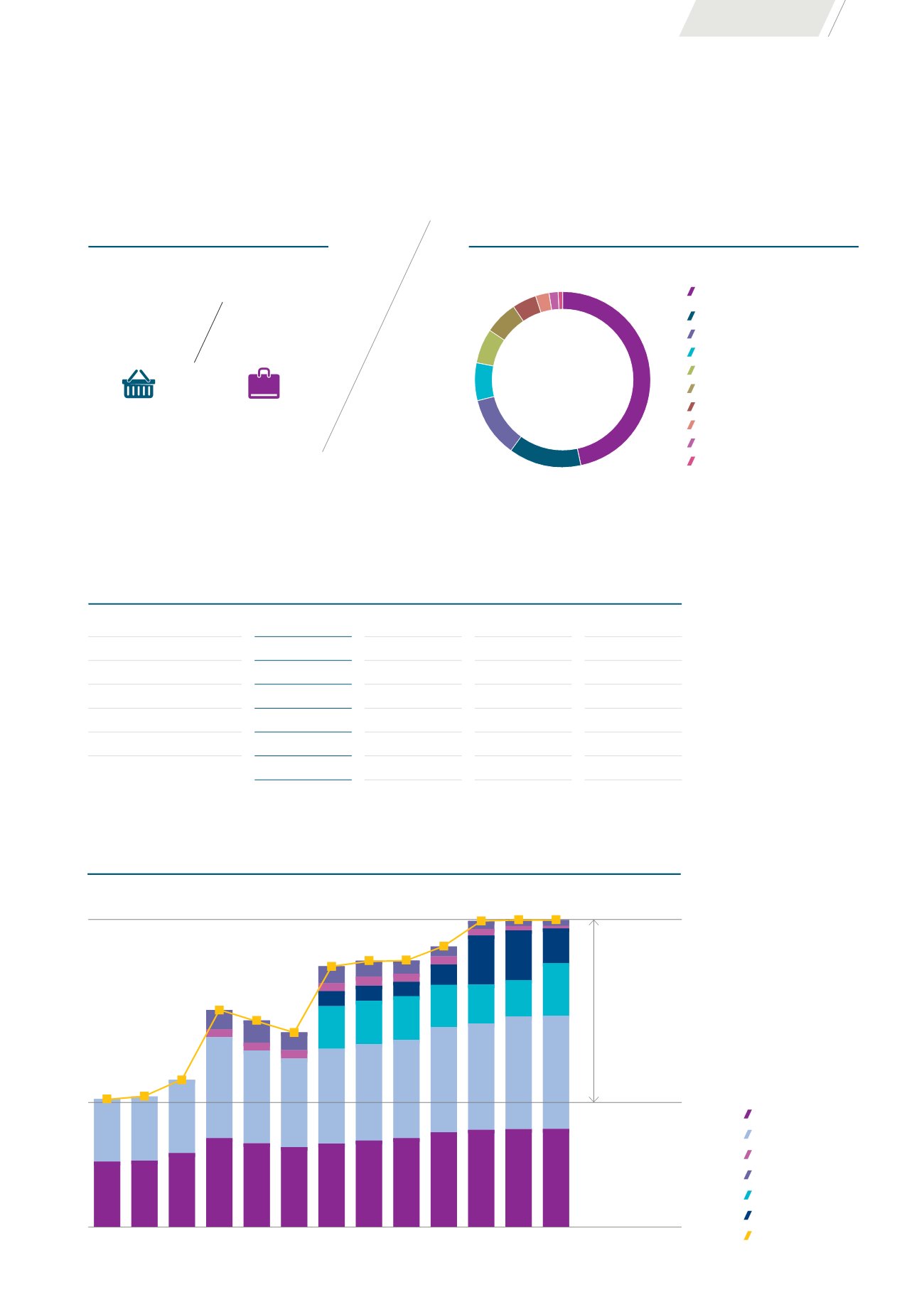

GROSS REVENUE BY RETAIL AND OFFICE

FY 2016/17

PORTFOLIO VALUATION

(S$ MILLION)

Notes:

(1)

Translated as at 30 June 2017

at A$0.95:S$1.00 (30 June 2016:

A$1.00:S$1.00).

(2)

Translated as at 30 June 2017

at RM3.12:S$1.00 (30 June 2016:

RM2.99:S$1.00).

(3)

Translated as at 30 June 2017

at JPY81.37:S$1.00 (30 June 2016:

JPY76.14:S$1.00).

(4)

Translated as at 30 June 2017

at RMB4.93:S$1.00 (30 June 2016:

RMB4.92:S$1.00).

PORTFOLIO VALUATION

DESCRIPTION

30 JUN 2017

(S$ MILLION)

30 JUN 2016

(S$ MILLION)

CHANGE

(S$ MILLION)

CHANGE

(%)

Wisma Atria Property

997.0

996.0

1.0

0.1%

Ngee Ann City Property

1,150.0

1,145.0

5.0

0.4%

Australia Properties

(1)

540.1

505.5

34.6

6.8%

Malaysia Properties

(2)

357.5

378.4

(20.9)

(5.5%)

Japan Properties

(3)

59.6

67.0

(7.4)

(11.0%)

China Property

(4)

32.1

44.7

(12.6)

(28.2%)

3,136.3

3,136.6

(0.3)

(0.0%)

Wisma Atria Property

Ngee Ann City Property

China Property

Japan Properties

Australia Properties

Malaysia Properties

Total

Sep 05 Dec 05 Dec 06 Dec 07 Dec 08 Dec 09 Dec 10 Dec 11 Dec 12 Dec 13 Jun 15 Jun 16 Jun 17

S$1,833 million

uplift since IPO

1,303 1,327

1,498

2,209

2,103

2,654

2,710 2,713

2,854

3,116 3,137 3,136

1,982

13.1

%

86.9

%

RETAIL

OFFICE

PORTFOLIO TRADE MIX

BY GROSS RENTAL CONTRIBUTION (AS AT 30 JUN 2017)

Master Tenancies &

Long-Term Leases

46.7%

Office

13.4%

Fashion

11.1%

F&B

6.9%

Jewellery & Watches

6.4%

Beauty & Wellness

6.3%

Shoes & Accessories

4.2%

General Trade

2.6%

Services

1.7%

Others

0.7%

OPERATIONS REVIEW

31