Japan Properties

China Property

Renhe Spring Zongbei Property

Renhe Spring Zongbei Property

is located in Chengdu, the capital

city of Sichuan province and

well-known as the hometown

of pandas, a popular tourist

destination. Chengdu is one of

the most populous cities of China

with a population of 14 million

and is the transit centre and

financial hub of Western China.

To accommodate increased

transportation demand, a second

airport has been planned with

scheduled completion in 2018.

The central government continued

the austerity economic strategy

which affected sales and the

high-end luxury retail market.

Nationwide retail sales growth

in 1H 2015 eased to 10.3%, down

from 12.4% in 1H 2014. In Chengdu,

retail sales growth in 1H 2015 also

eased to 10.9% compared to 13.6%

in 1H 2014.

The property comprises four

levels of retail space and a café

on a mezzanine floor with a GFA

of approximately 100,854 sq ft.

Both basement and road level

parking facilities are available.

A Mass Rapid Transit station is also

located in front of the property. It

is surrounded by consulates and

high-end residences. Operating

as a department store with

concessionaires, international

brands present include Armani

Collezioni, Dunhill, Ermenegildo

Zegna, Hugo Boss, Max Mara

Weekend and Rolex. Occupancy

has been maintained at 100% since

acquisition in August 2007.

Oversupplied retail space during

the austerity measures

period intensified the market

competition. The retail landscape

in Chengdu continued to be

challenging which negatively

affected the performance of

Renhe Spring Zongbei Property

for FY 2013 and FY 2014/15.

Nonetheless, Renhe Spring

Zongbei Property remains focused

on fine-tuning the tenancy mix

and cost containment.

The Renhe Spring Zongbei Property is located in

a high income area and surrounded by grade A

buildings and high-end residences.

RENHE

SPRING

ZONGBEI

PROPERTY

No. 19, 4th Section,

Renminnan Road, Chengdu, China

S$

70.6m

PURCHASE

PRICE

S$

66.3m

MARKET

VALUATION

(as at 30 Jun 2015)

TOTAL GFA (SQ FT)

100,854

Leasehold

Estate

(expiring on

27 Dec 2035)

MONTHLY SALES YOY COMPARISON

(RMB millions) including VAT

2015

2014 2013

Jan Feb Mar Apr May Jun Jul

Aug Sep Oct Nov Dec

60.0

50.0

40.0

30.0

20.0

10.0

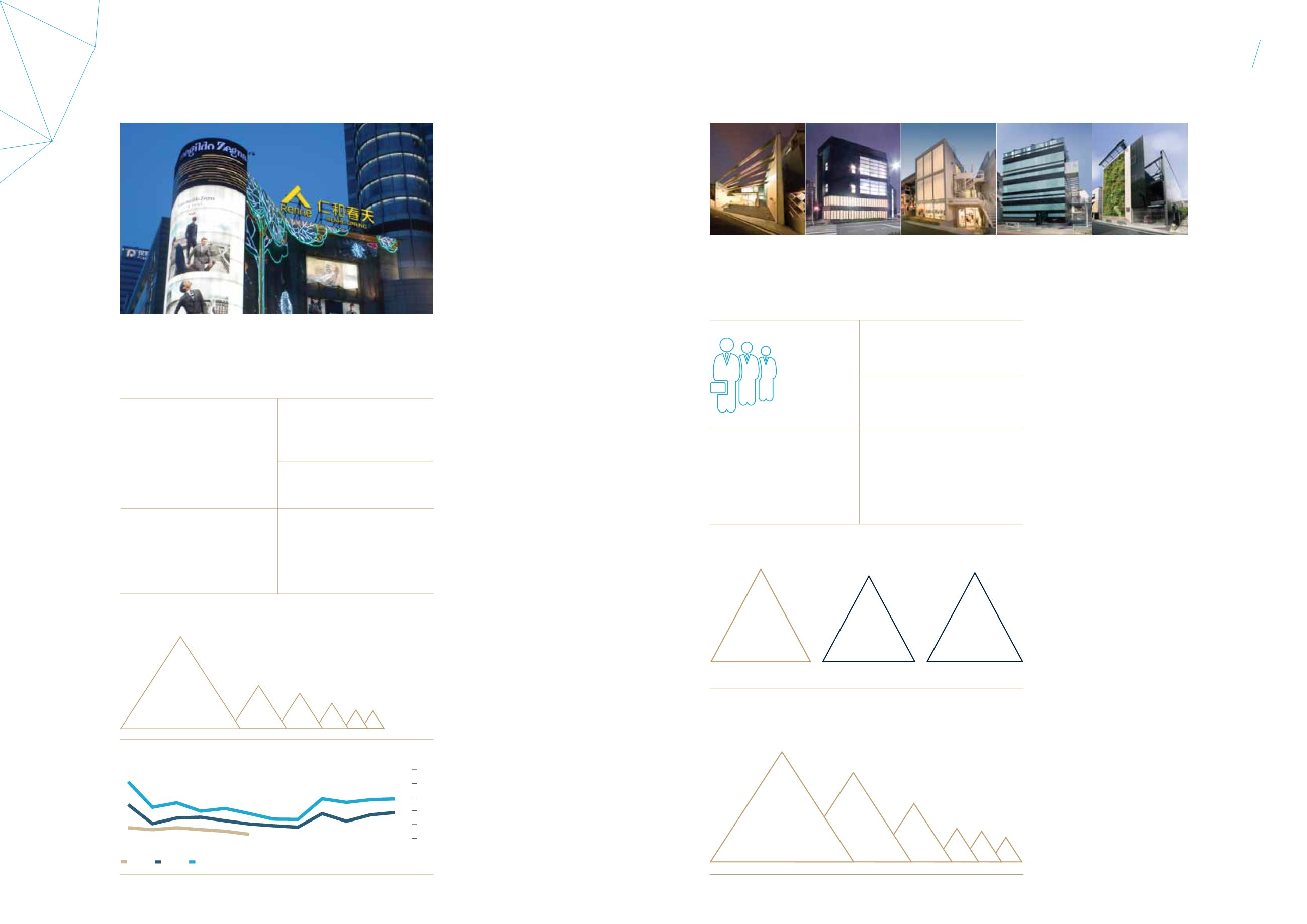

As at 30 June 2015, Starhill Global

REIT’s Japan portfolio consists of

five contemporary commercial

buildings located in the heart

of prime Tokyo in areas such as

Harajyuku, Ebisu and Roppongi,

within walking distance from

major subway stations. The

portfolio was refined in March

2014 with the divestment of

Holon L at a sale consideration

of JPY1,026.0 million (or

approximately S$12.8 million).

These five properties are targeted

to appeal to young and stylish

urbanites from the mid-income

segment. As at 30 June 2015,

the Japan Properties with a total

NLA of approximately 47,130 sq

ft enjoyed an overall portfolio

occupancy of 96.1%, with four of

them fully occupied.

Having weighed the costs and

benefits of earthquake insurance

for the Japanese assets, the

claimable sum and that their

contribution to Starhill Global

REIT’s portfolio is approximately

2.6% by asset value as at 30 June

2015, no specific earthquake

insurance has been taken up,

which is consistent with the

industry practice in Japan.

S$

146.2 m

(1)

PURCHASE

PRICE

S$

81.9 m

MARKET

VALUATION

(as at 30 Jun 2015)

16

TOTAL NLA (SQ FT)

47,130

TENURE

Freehold

1

F&B

46.0%

2 Others

30.4%

3 Services

13.3%

4 General Trade

4.4%

5 Health & Beauty

3.6%

6 Fashion

2.3%

RETAIL TRADE MIX

by gross rental contribution

(for Jun 2015)

6 5 4 3

2

1

Note:

(1)

Excludes Holon L which was divested

to Tadashi Kumazaki in March 2014

at JPY1,026 million, 6% above the

independent valuation done as at

31 December 2013. The open

market value was derived using the

discounted cash flow and income

capitalisation methods.

Starhill Global REIT’s Japan portfolio consists of five contemporary

commercial buildings located within walking distance from major

subway stations in prime Tokyo areas.

Ebisu Fort

Harajyuku Secondo Nakameguro Place

Roppongi Terzo

Daikanyama

NUMBER

OF TENANTS

as at 30 Jun 2015

OCCUPANCY RATE

30 Jun 2015

Retail

96.1%

31 Dec 2013

Retail

89.8%

31 Dec 2012

Retail

92.7%

1

Fashion

74.6%

2 Accessories

11.2%

3 Jewellery & Watches

7.7%

4 Leather Goods

3.7%

5 Café

1.5%

6 Cosmetics & Healthcare

1.3%

RETAIL TRADE MIX

by gross rental contribution

(for Jun 2015)

65 4

2

1

3

TENURE

40

YEARS

57

56

STARHILL

GLOBAL

REIT

Annual

Report

FY 2014/15