Sustainability

Corporate Governance

may seek advice from the Singapore Institute of Directors

or external search consultants. Selections and nominations

are made based on the following guidelines:

•

Integrity;

•

Relevant expertise (sector and functional) and the

degree to which his or her skill set complements the

skill set of the other Board members;

•

Reputation and standing in the market; and

•

In the case of prospective Independent Directors,

independence based on the criteria in the Code.

Board Performance

Principle 5:

There should be a formal assessment of the effectiveness

of the Board as a whole and its Board committees and

the contribution by each director to the effectiveness

of the Board.

The Manager believes that the performance of the

Manager, and the Board, is reflected in the long term

success of Starhill Global REIT.

Reviews of Board performance are conducted once a

year. Directors are required to complete a questionnaire

evaluating the Board and the Audit Committee.

The questionnaire covers areas such as Board

composition, access to information, Board processes,

risk management, Board training and development

programme, understanding of the business, strategic

planning and any specific areas where improvements

may be made. Pursuant to the Board evaluation

process, the Board is satisfied that it has achieved its

performance objectives for FY 2014/15.

In cases where the Director(s) have multiple listed

board representations, the Board conducts an annual

review to ensure that they are able to and have been

devoting sufficient time to discharge their responsibilities

adequately. Each Director confirmed his ability to devote

sufficient time and attention to the affairs of the Manager

and Starhill Global REIT, having regard to all his other

listed company board representations and other principal

commitments. Notwithstanding that some of the Directors

have multiple board representations, the Board is satisfied

that each Director is able to and has been adequately

carrying out his duties as a Director of the Manager.

The Manager believes that contributions from each

Director go beyond his attendance at Board and

committee meetings. Contributions by an individual

Board member take other forms, including providing

objective perspectives of issues, facilitating business

opportunities and strategic relationships, and accessibility

to Management outside of a formal environment of

Board and/or Audit Committee meetings. A Director

of the Manager would have been appointed on the

principles outlined earlier in this statement, and on his/

her ability to contribute to the proper guidance of the

Manager in its management of Starhill Global REIT.

information flow between the Board and its committees

and between Management and non-executive Directors

and advising the Board on all governance matters.

The company secretary attends all Board and Audit

Committee meetings of the Manager to take minutes.

The appointment and removal of the company secretary

is a Board reserved matter.

(B) REMUNERATION MATTERS

Procedures for Developing Remuneration Policies

Principle 7:

There should be a formal and transparent procedure

for developing policy on executive remuneration and

for fixing the remuneration packages of individual

directors. No director should be involved in deciding

his own remuneration.

Level and Mix of Remuneration

Principle 8:

The level and structure of remuneration should be

aligned with the long-term interest and risk policies

of the company, and should be appropriate to attract,

retain and motivate (a) the directors to provide good

stewardship of the company, and (b) key management

personnel to successfully manage the company.

However, companies should avoid paying more than

is necessary for this purpose.

Disclosure on Remuneration

Principle 9:

Every company should provide clear disclosure of its

remuneration policies, level and mix of remuneration, and

the procedure for setting remuneration in the company’s

Annual Report. It should provide disclosure in relation to

its remuneration policies to enable investors to understand

the link between remuneration paid to directors and key

management personnel, and performance.

The remuneration of Directors and staff of the Manager

is paid by the Manager from the fees it receives from

Starhill Global REIT, and not by Starhill Global REIT itself.

As Starhill Global REIT does not bear the remuneration

of the Manager’s Board and staff, and the Manager is

a wholly-owned subsidiary of YTL Corp, the Manager

does not consider it necessary to have a remuneration

committee or to include a report on remuneration of its

Directors and key executives.

(C) ACCOUNTABILITY AND AUDIT

Accountability

Principle 10:

The Board should present a balanced and understandable

assessment of the company’s performance, position and

prospects.

The Manager provides Unitholders with quarterly and

annual financial statements. The Board, with the support

of Management, is responsible for providing a balanced

and informed assessment of Starhill Global REIT’s

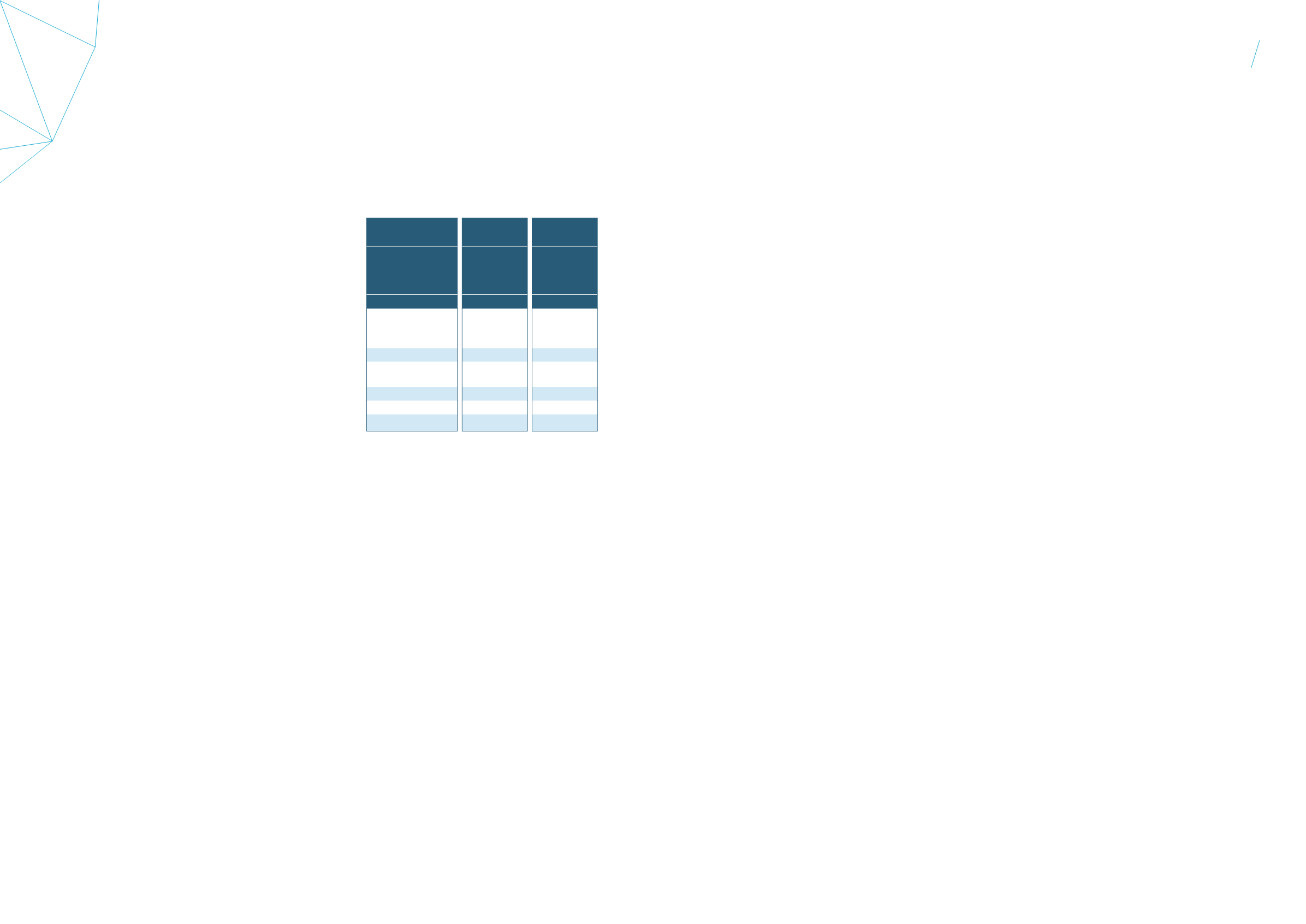

In the year under review, the number of Board and

Audit Committee meetings held and attended by

each Board member is as follows:

Board

Audit

Committee

No. of

meetings held

in FY 2014/15:

6

No. of

meetings held

in FY 2014/15:

6

Attended

Attended

Tan Sri Dato’

(Dr) Francis

Yeoh Sock Ping

5

NA

Mr Ho Sing

6

NA

Dato’ Yeoh

Seok Kian

6

NA

Mr Keith Tay Ah Kee

6

6

Dr Hong Hai

6

6

Mr Michael Hwang

6

5

Access to Information

Principle 6:

In order to fulfil their responsibilities, Directors should be

provided with complete, adequate and timely information

prior to board meetings and on an on-going basis so as to

enable them to make informed decisions to discharge their

duties and responsibilities.

Management provides the Board with regular updates

on financial results, market and business developments,

and business and operational information. Board papers

and agenda are provided to each Director in advance of

Board meetings so that Directors can review and consider

the matters being tabled beforehand. Management

provides the Board with management accounts of

Starhill Global REIT on a quarterly basis to enable the

Board to keep abreast of Starhill Global REIT’s financial

performance. In addition, as and when any significant

matter arises, Management promptly brings these matters

to the Board’s attention and provides the Board with the

relevant financial information.

Where necessary, senior members of Management

participate in Board meetings to provide additional

insights and to respond to any queries from Directors.

The Board has unfettered access to senior members of

Management and the company secretary at all times.

The Board also has access to independent professional

advice (legal, financial or otherwise) where appropriate

or necessary. The company secretary of the Manager

will render necessary assistance to the Board and will

ensure that the Board procedures are followed and that

applicable laws and regulations are complied with. Under

the direction of the Executive Chairman, the company

secretary’s responsibilities include ensuring good

performance, position and prospects, including interim

and other price-sensitive public reports, and reports to

regulators (if required). Management provides the Board

with management accounts on a quarterly basis and as

the Board may require from time to time to enable the

Board to make a balanced and informed assessment.

Financial reports and other material information are

disseminated to Unitholders through announcements to

SGX-ST via SGXNET, Starhill Global REIT’s website and

where applicable, press releases, of the performance,

position and prospects of Starhill Global REIT.

Risk Management and Internal Controls

Principle 11:

The Board is responsible for the governance of risk.

The Board should ensure that the Management maintains

a sound system of risk management and internal controls

to safeguard shareholders’ interests and the company’s

assets, and should determine the nature and extent of

the significant risks which the Board is willing to take in

achieving its strategic objectives.

Effective risk management is a fundamental part of

Starhill Global REIT’s business strategy. Recognising and

managing risk is central to the business and to protecting

Unitholders’ interests and value. The Manager has in place

an enterprise risk management framework and policies,

which have been approved by the Board that provide

a structured approach to identifying and managing the

material risks that could arise in the course of managing

Starhill Global REIT. The framework and policies are

monitored and reviewed by the Board as and when

appropriate, and major developments and significant

revisions to the framework or policies will be submitted

to the Board for approval. An independent consultant

also reviews the risk management framework and the

identified risks and control activities, and provide a report

to the Board once every two years. Material risks at both

the Manager and Starhill Global REIT levels are managed

through this risk management framework.

The Audit Committee has also been tasked by the Board

to include risk management within its oversight role.

This includes the review of material risks identified by

management with respect to the business operations of

the Manager, Starhill Global REIT and the assets of Starhill

Global REIT.

Application of the policies and protocol under the

framework in respect of Starhill Global REIT assets

and operations is further described in the section

“Risk Management” on page 66.

The Manager has put in place a system of internal controls,

compliance procedures and processes to safeguard

Starhill Global REIT’s assets and Unitholders’ interests,

manage risks and ensure compliance with high standards

of corporate governance. Financial risk management

is exercised in accordance with a robust policy. During

75

74

STARHILL

GLOBAL

REIT

Annual

Report

FY 2014/15