Capital

Management

PRUDENT CAPITAL

MANAGEMENT TO OPTIMISE

UNITHOLDERS’ RETURNS

Starhill Global REIT’s main objective

when managing capital is to optimise

Unitholders’ returns through a mix of

available capital sources. The Group

monitors capital on the basis of

both the gearing ratio and interest

service coverage ratio and maintains

them within the approved limits. The

Group assesses its capital management

approach as a key part of the Group’s

overall strategy and this is continuously

reviewed by the Manager.

In February 2014, the Group issued

S$100 million unsecured seven-year

3.5% Series 002 MTN (maturing in

February 2021) under its S$2 billion

multicurrency MTN programme,

with the net proceeds used to repay

the existing debts and for working

capital purposes.

In May 2014 and June 2014,

approximately JPY0.2 billion

(S$2.5 million) of JPY1.4 billion bond

and JPY0.7 billion (S$8.6 million) of

JPY7 billion term loan were repaid

using sales proceeds from the

divestment of Holon L. In June 2014,

the Group extended the maturity of

its existing secured A$63 million term

loan by two years to June 2019, at

a lower interest margin effective

from June 2014.

In September 2014, the Group

completed the refinancing of

RM330 million MTN ahead of its

expected maturity in June 2015 by

buying back and cancelling the

First Senior MTN and issuing new

five-year secured and fixed-rate

Second Senior MTN of a nominal

value of RM330 million at a

discounted cash consideration of

approximately RM325 million. The

Second Senior MTN bear a fixed

coupon rate of 4.48% per annum

and have a carrying amount of

approximately RM326.2 million

(S$116.2 million) as at 30 June 2015.

In April 2015, the Group entered

into an agreement with the

same banks to secure a five-year

unsecured loan facility to refinance

the JPY6.3 billion term loan ahead of

its maturity in September 2016. The

loan was subsequently drawn in

July 2015 and the maturity extended

to July 2020.

In May 2015, the Group entered into

a three-year unsecured term loan

facility of S$250 million, of which

S$100 million was drawn in June

2015 to refinance the S$100 million

term loan ahead of its maturity in

September 2016. The remaining

S$150 million term loan facility was

drawn in July 2015. The Group also

entered into a three-year secured

term loan facility of A$145 million,

which was drawn in May 2015 to

partially fund the acquisition of Myer

Centre Adelaide in Australia.

In May 2015, the Group issued

S$125 million unsecured eight-year

3.4% Series 003 MTN (maturing in

May 2023), with the net proceeds

used to repay existing debts and for

working capital purposes.

As at 30 June 2015, Starhill Global

REIT’s outstanding debt stood

at approximately S$1,135 million

with a gearing ratio of 35.5%, and

approximately S$2.3 billion (73%) of

the Group’s investment properties

are unencumbered, enhancing its

financial flexibility. The Manager

intends to continue with its prudent

capital management.

Starhill Global REIT’s current financial

risk management policy is described

in greater details below.

INTEREST RATE RISK

MANAGEMENT

In order to protect the Group’s

earnings from interest rate volatility

and provide stability to Unitholders’

returns, Starhill Global REIT may

hedge substantially its interest rate

exposure within the short to medium

term by using fixed rate debt and

interest rate derivatives including

interest rate swaps and caps.

As at 30 June 2015, Starhill Global

REIT hedged 100% of its debt,

of which 81% were hedged by a

combination of fixed rate debt

and interest rate swaps, and

the remaining 19% were hedged

using interest rate caps. The

weighted average interest rate was

approximately 3.19% per annum as

at 30 June 2015. The interest service

coverage ratio was a healthy

5.2 times for the 18 months ended

30 June 2015. The Manager intends

to continue to secure diversified

funding sources from both financial

institutions and capital markets when

opportunities arise, while keeping

Starhill Global REIT’s ongoing cost

of debt competitive.

FOREIGN EXCHANGE RISK

MANAGEMENT

As at 30 June 2015, Starhill Global

REIT is exposed to foreign exchange

risk arising from its investments

in Australia, Malaysia, China and

Japan. The income generated

from these investments and net

assets are denominated in foreign

currencies. In managing its currency

risks associated with its foreign

investments, Starhill Global REIT has

adopted the following income and

capital hedging strategies.

Income hedging

Starhill Global REIT’s core portfolio

is largely based in Singapore, which

contributed approximately 67% of

its revenue for the 18 months ended

30 June 2015. Starhill Global REIT

actively monitors the exchange rates

and assesses hedging on a case-

by-case basis. The impact of the

volatility in the foreign currencies

namely Australian dollar, Malaysian

Ringgit and Japanese Yen on its

distributions has been partially

mitigated by having foreign currency

denominated borrowing as a natural

hedge, and short-term foreign

currency forward contracts to hedge

part of its net foreign income.

Capital hedging

In managing the currency risks

associated with the capital values of

Starhill Global REIT’s overseas assets,

borrowings are denominated in the

same currency as the underlying

assets to the extent feasible, to

provide a natural currency hedge.

As the investments in overseas assets

are generally long term in nature,

the remaining net positions of

the foreign exchange risk on such

investments are not hedged.

DEBT GEARING AND HIGHLIGHTS

As at 30 June 2015

SGD term loans

S$350m

JPY term loan

S$69m

SGD RCF

S$22m

Singapore MTNs

S$349m

Malaysia MTN

S$116m

Australia loans

S$215m

Japan bond

S$14m

Total Debt

S$1,135m

Gearing ratio

(1)

35.5%

Fixed/hedged debt ratio

(2)

100%

Unencumbered assets ratio

73%

Interest cover for the 18 months ended 30 June 2015

5.2x

Weighted average interest rate per annum

(3)

3.19%

Starhill Global REIT corporate rating:

– Standard & Poor’s

(4)

BBB+

Notes:

(1)

Based on consolidated deposited property.

(2)

Including interest rate derivatives such as interest rate swaps and caps.

(3)

As at 30 June 2015. Includes interest rate derivatives but excludes upfront costs.

(4)

Standard & Poor’s has affirmed its “BBB+” rating in April 2015, with a stable outlook.

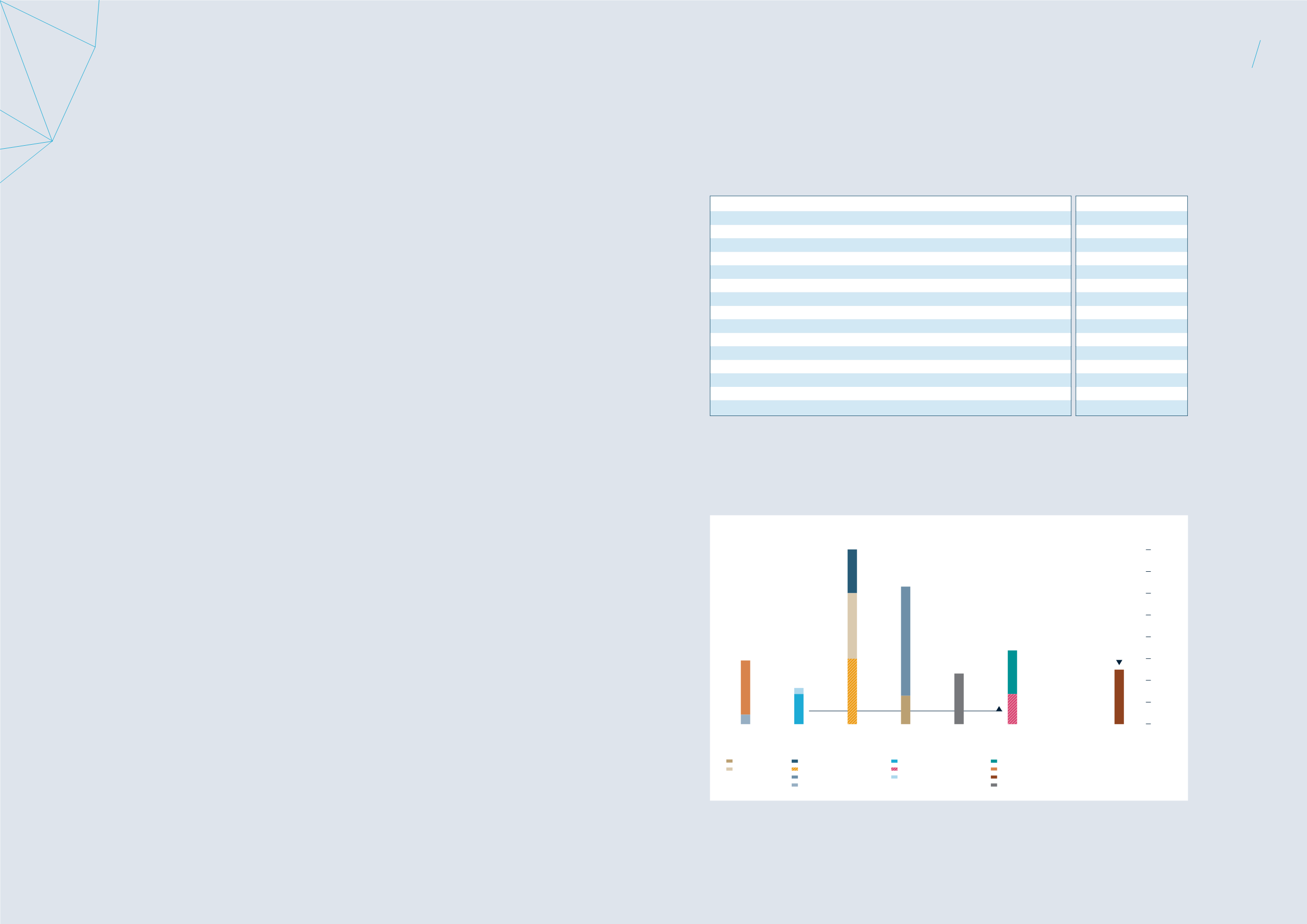

Notes:

(1)

In July 2015, the Group has fully repaid the S$124 million Series 001 MTN upon maturity and the outstanding short-term RCF of S$22 million.

(2)

In July 2015, the Group has refinanced its unsecured JPY6.3 billion term loan ahead of maturity in September 2016 with the same banks,

with a new maturity in July 2020.

(3)

In July 2015, the Group has utilised the remaining S$150 million from a three-year unsecured S$250 million term loan facility, which was

earmarked to partially fund the acquisition of Myer Centre Adelaide.

(4)

Post July 2015, the Group’s average debt maturity profile is approximately 4.1 years and there is no significant debt refinancing

requirement until year 2018.

A$63m loan

S$100m term loan

JPY6.3b term loan

S$100m MTN

A$145m loan

S$150m term loan (new)

JPY6.3b term loan (new)

S$124m MTN

S$250m term loan

JPY1.2b bond

S$125m MTN

S$22m RCF

RM330m MTN

DEBT MATURITY PROFILE

As at 30 June 2015

FY

2015/16

(4)

FY

2016/17

FY

2017/18

FY

2018/19

FY

2019/20

FY

2020/21

FY

2021/22

FY

2022/23

124

(1)

150

100

250

116

125

100

69

(2)

14

69

(2)

22

(1)

150

(3)

65

400

350

300

250

200

150

100

50

0

Issued in

May 2015 to

refinance the

S$124 million

Series 001 MTN

maturing in

July 2015

S$ million

65

64

STARHILL

GLOBAL

REIT

Annual

Report

FY 2014/15