CAPITAL

MANAGEMENT

PRUDENT CAPITAL MANAGEMENT TO

OPTIMISE UNITHOLDERS’ RETURNS

Starhill Global REIT’s main objective

when managing capital is to optimise

Unitholders’ returns through a mix of

available capital sources. The Group

monitors capital on the basis of both

the gearing ratio and interest service

coverage ratio and maintains them

within the approved limits. The Group

assesses its capital management

approach as a key part of the Group’s

overall strategy and this is continuously

reviewed by the Manager.

In August 2016, the Group issued

five-year Series 3 Japan bond of

JPY0.8 billion (maturing in August 2021).

The proceeds of issuance were used

to redeem the Series 2 Japan bond of

JPY0.8 billion ahead of its maturity in

November 2016.

In October 2016, the Group issued

S$70 million unsecured 10-year 3.14%

Series 004 MTN (maturing in October

2026) under its S$2 billion Multicurrency

MTN Programme. S$50 million of the

net proceeds were used in December

2016 to prepay part of the S$250 million

term loan maturing in September 2018,

while the balance was used to meet

capital expenditure requirements and/

or for working capital purposes.

In November 2016, JPY0.8 billion of the

remaining JPY5.2 billion term loan was

prepaid using sales proceeds from the

divestment of Roppongi Terzo.

In June 2017, the Group entered into

an agreement with the same bank for

an approximately four-year secured

term loan facility of A$145 million to

refinance its existing loan of the same

amount in November 2017, ahead of its

maturity in May 2018.

In July 2017, the Group entered into

an unsecured facility agreement with

a club of seven banks, comprising

(a) four-year term loan facility of

S$200 million; (b) five-year term

loan facility of S$260 million; and (c)

five-year revolving credit facilities of

S$240 million (of which S$50 million

is uncommitted), which will be used

to refinance the existing unsecured

S$250 million and S$200 million term

loans in September 2017, ahead of

their respective maturities in June 2018

and September 2018, with the balance

available for working capital purposes.

Following the above early refinancing

of the S$ and A$ term loans, the

average debt maturity profile will be

lengthened from 2.6 years as at

30 June 2017 to approximately 4.5

years and Starhill Global REIT would

have no significant refinancing

requirement until June 2019.

In July and August 2017, the Group

has prepaid JPY350 million term loan

and JPY55 million Series 3 Japan bond

respectively using the net proceeds

from the divestment of Harajuku

Secondo in May 2017.

As at 30 June 2017, Starhill Global

REIT’s outstanding debt stood

at approximately S$1,137 million

with a gearing ratio of 35.3%, and

approximately S$2.3 billion (73%) of

the Group’s investment properties

are unencumbered, enhancing its

financial flexibility. The Manager

intends to continue with its prudent

capital management.

Starhill Global REIT’s current financial

risk management policy is described

in greater details below.

INTEREST RATE RISK MANAGEMENT

In order to protect the Group’s

earnings from interest rate volatility

and provide stability to Unitholders’

returns, Starhill Global REIT hedges

substantially its interest rate

exposure within the short to medium

term by using fixed rate debt and

interest rate derivatives including

interest rate swaps and caps.

As at 30 June 2017, Starhill Global

REIT hedged about 99% of its debt,

of which 88% were hedged by a

combination of fixed rate debt

and interest rate swaps, and the

remaining 11% were hedged using

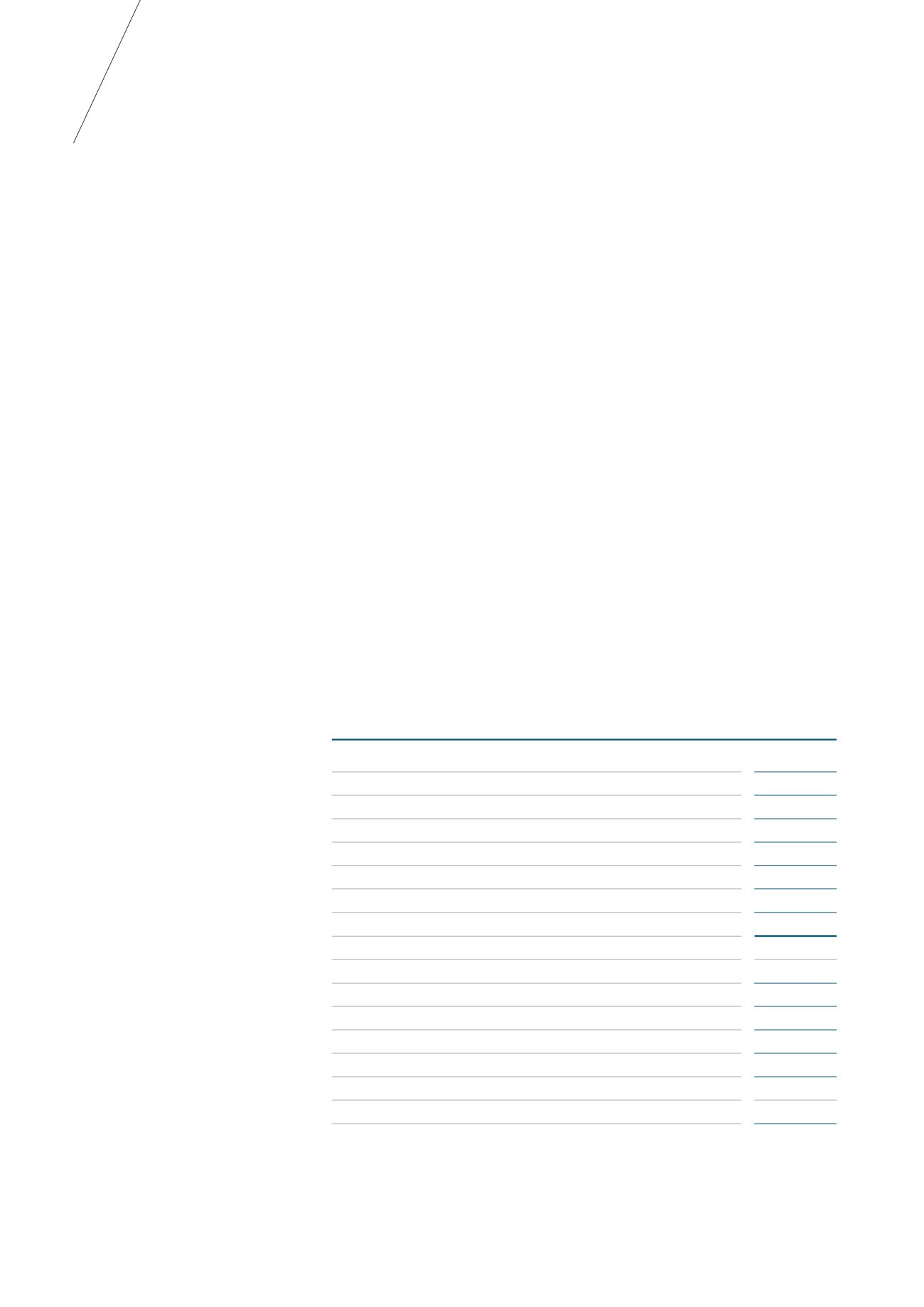

DEBT GEARING AND HIGHLIGHTS

AS AT 30 JUN 2017

SGD term loans

S$450m

JPY term loan

S$54m

SGD RCF

S$3m

Singapore MTNs

S$295m

Malaysia MTN

S$105m

Australia term loans

S$220m

Japan bond

S$10m

Total Debt

S$1,137m

Gearing ratio

(1)

35.3%

Fixed/hedged debt ratio

(2)

99%

Unencumbered assets ratio

73%

Interest cover for the year ended 30 June 2017

4.2x

Weighted average interest rate per annum

(3)

3.16%

Starhill Global REIT corporate rating:

- Standard & Poor’s

(4)

BBB+

Notes:

(1)

Based on consolidated deposited property.

(2)

Including interest rate derivatives such as interest rate swaps and caps.

(3)

As at 30 June 2017. Includes interest rate derivatives but excludes upfront costs.

(4)

Standard & Poor’s has affirmed its “BBB+” rating in March 2017, with a stable outlook.

56

STARHILL GLOBAL REIT ANNUAL REPORT FY 2016/17