interest rate caps. The weighted

average interest rate was

approximately 3.16% per annum as

at 30 June 2017. The interest service

coverage ratio was a healthy

4.2 times for the year ended 30

June 2017. The Manager intends

to continue to secure diversified

funding sources from both financial

institutions and capital markets

when opportunities arise, while

keeping Starhill Global REIT’s

ongoing cost of debt competitive.

FOREIGN EXCHANGE RISK

MANAGEMENT

As at 30 June 2017, Starhill Global

REIT is exposed to foreign exchange

risk arising from its investments

in Australia, Malaysia, China and

Japan. The income generated

from these investments and net

assets are denominated in foreign

currencies. In managing its currency

risks associated with its foreign

investments, Starhill Global REIT has

adopted the following income and

capital hedging strategies.

Income hedging

Starhill Global REIT’s core portfolio

is largely based in Singapore, which

contributed approximately 62% of its

revenue for the year ended 30 June

2017. Starhill Global REIT actively

monitors the exchange rates and

assesses hedging on a case-by-case

basis. The impact of the volatility

in the foreign currencies mainly

Australian dollar and Malaysian

Ringgit on its distributions has been

partially mitigated by having foreign

currency denominated borrowing

as a natural hedge, and short-term

foreign currency forward contracts.

Capital hedging

In managing the currency risks

associated with the capital values of

Starhill Global REIT’s overseas assets,

borrowings are denominated in the

same currency as the underlying

assets to the extent feasible, to

provide a natural currency hedge. As

the investments in overseas assets

are generally long term in nature, the

remaining net positions of the foreign

exchange risk on such investments

are not hedged.

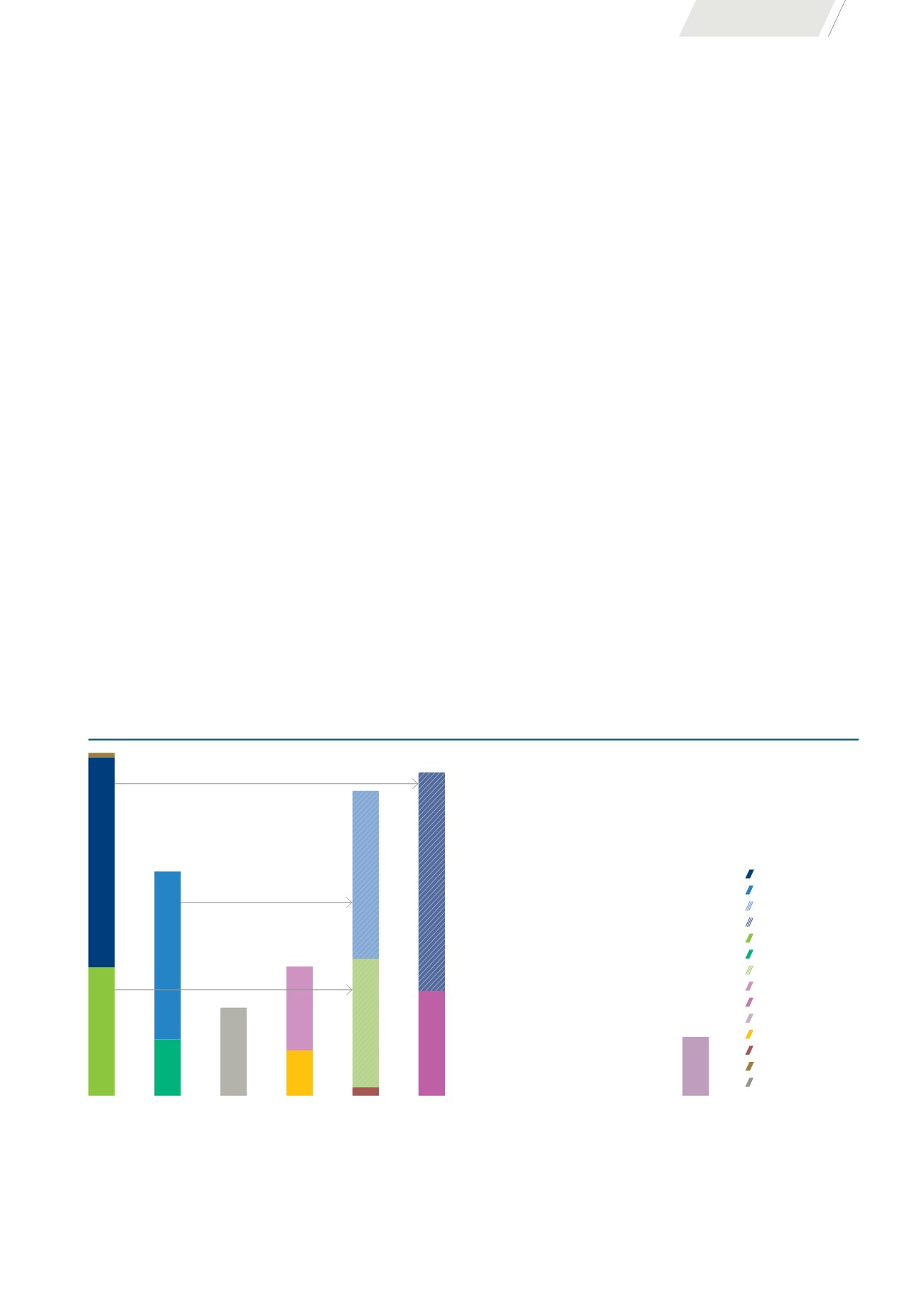

DEBT MATURITY PROFILE

AS AT 30 JUN 2017 (S$ MILLION)

FY 2017/18

FY 2018/19

FY 2019/20

FY 2020/21

FY 2021/22

FY 2022/23

FY 2023/24

FY 2024/25

FY 2025/26

FY 2026/27

Notes:

(1)

In June 2017, the Group has secured the refinancing of its A$145 million loan with the same bank ahead of its maturity in May 2018. The utilisation is expected to take place in

November 2017, which will extend the maturity to November 2021.

(2)

In July 2017, the Group has secured the refinancing of its S$250 million and S$200 million loans ahead of their respective maturities in June 2018 and September 2018.

The utilisation of the new facilities with a club of seven banks, comprising four and five year tranches, are expected to take place in September 2017.

(3)

In July and August 2017, the Group has prepaid JPY350 million term loan and JPY55 million Series 3 Japan bond respectively using the net proceeds from the divestment of

Harajuku Secondo in May 2017.

(4)

The Group has fully repaid the outstanding short-term RCF of S$3 million in July 2017.

153

153

(1)

54

(3)

250

3

(4)

260

(2)

200

(2)

200

67

70

105

100

125

10

(3)

S$250m term loan

S$200m term loan

S$200m term loan (new)

S$260m term loan (new)

A$145m loan

A$63m loan

A$145m loan (new)

S$100m MTN

S$125m MTN

S$70m MTN

JPY4.4b term loan

JPY0.8b bond

S$3m RCF

RM330m MTN

PERFORMANCE

57