Market

Overview

SINGAPORE RETAIL PROPERTY

MARKET

According to Singapore’s Ministry of Trade and

Industry (MTI), Singapore’s GDP expanded by

1.8% yoy in the second quarter of 2015 based

on advanced estimates, a decline from the 2.8%

growth recorded in 1Q 2015

(1)

. The first half of

the year recorded weaker than expected global

economic performance, while growth outlook

for the regional economies remain soft on the

back of further easing in China’s growth. The

country’s economy is expected to grow by 2.0%

to 2.5% in 2015, from the earlier projected 2.0%

to 4.0%

(1)

.

Tourist arrivals to Singapore from January to

June 2015 reached 7.3 million, representing a

10.0% yoy decline

(2)

. However in 2014, tourism

receipts held steady at S$23.6 billion over 2013,

despite a 3% fall in international visitor arrivals

to 15.1 million

(3)

. In recognition of headwinds in

Singapore’s tourism sector this year, Singapore

Tourism Board (“STB”) announced a slew of

marketing campaigns including a S$35 million

joint campaign between Changi Airport Group

(CAG) and STB

(4)

and a S$20 million global

marketing campaign which will be done in

conjunction with Singapore’s Golden Jubilee

celebrations

(5)

. STB projects tourist arrivals

to remain stable between 15.1 to 15.5 million

in 2015, with tourism receipt to range between

S$23.5 billion and S$24.0 billion

(5)

.

According to CBRE, the average prime

Orchard Road retail rents was relatively flat

yoy in 2Q 2015 at S$34.00 per square foot

per month (psfpm) as the industry continued

to be challenged with lower number of

tourist arrivals and manpower restrictions

(6)

.

However, demand for prime Orchard Road

space continues to hold up as there is no

known major supply from 2015 onwards

(6)

and

Singapore’s luxury goods demand continues

to be supported by the increase in per capita

expenditure of tourists

(7)

. According to CBRE,

Singapore remains attractive to international

retailers seeking a presence in the Asia-Pacific

region, with 58 new-to-market entrants in

2014

(8)

. However, the domestic labour market

is expected to remain tight and consequently,

labour-intensive sectors such as retail and food

services may see their growth weighed down

by manpower constraints. The retail landscape

in Singapore remains tepid with the retail sales

index in Singapore (excluding motor vehicle

sales) declining 3.9% yoy in June 2015

(9)

.

SINGAPORE OFFICE PROPERTY

MARKET

For the office sector, average rents for Grade

A and B space increased to S$11.30 psfpm

and S$8.05 psfpm respectively on the back

of tightness of available space and lower

vacancies

(6)

. However, the large influx of new

supply from 2H 2016 onwards will likely exceed

expected absorption levels which might result

in a slowdown in rental demand

(6)

. According

to CBRE, there is no known office supply in the

pipeline within the Orchard Road vicinity till 2018.

AUSTRALIA RETAIL PROPERTY

MARKET

On a seasonally-adjusted chain volume basis,

the Australian economy grew 0.2% in 2Q 2015,

a qoq decline from the 0.9% growth in 1Q 2015,

owing to reduced mining and consumption

activity, coupled with a decline in exports

(10)

.

Retail sentiment remains buoyed by low interest

rates, with the national retail turnover at 4.8%

yoy growth in seasonally-adjusted terms for the

12 months to June 2015

(10)

. Australia’s prime CBD

retail precincts continue to attract international

retailers with more than 40 new foreign retailers

entered the market in 2014

(11)

. The retail market

in Adelaide is showing signs of strength as a

number of international retailers begin their store

roll-outs

(12)

, as Rundle Mall remains the prime

location in the Adelaide CBD

(11)

. International

retailers, Topshop and Zara, opened their new

stores in Perth in October 2014, while Williams

Sonoma opened its Pottery Barn, Pottery Barn

Kids and West Elm stores in Hay Street Mall in

July 2015

(13)

.

MALAYSIA RETAIL PROPERTY

MARKET

In the second quarter of 2015, Malaysia’s

economy expanded at 4.9% supported

by continued expansion in services and a

turnaround in agricultural production

(14)

. The

introduction of the goods and services tax,

weakening ringgit and current political issues

have affected consumer sentiments in Malaysia,

thus having a negative impact on the retail

sector, said the Retail Group Malaysia. It hopes

the current trends are temporary and that they

would recover by year-end. In July 2015, the

Malaysia Retailers Association had also revised

its growth outlook for 2015 from 4.9% to 4%

on the back of higher cost of living resulting

from weaker ringgit and rising cost of doing

business

(15)

. Tourist arrivals declined 8.6% yoy

for the first quarter of 2015

(16)

in view of the

impact of the airline tragedies in 2014. However,

the Malaysian tourism authority believes the

weakened ringgit would be beneficial to the

industry

(17)

. According to Knight Frank, Klang

Valley is expected to see up to 4.5 million sq

ft of retail space expansion up by early 2016

after adding about 1.9 million sq ft in 1H 2015.

However, the core Bukit Bintang shopping

district is likely to see limited new retail supply

till 2017

(18)

.

CHENGDU RETAIL PROPERTY

MARKET

In China, the government’s effort to moderate

economic growth continued to impact market

Sources:

1. Ministry of Trade and Industry Singapore, MTI

Narrows 2015 GDP Forecast to 2.0 to 2.5 Per Cent,

11 August 2015

2. Singapore Tourism Board, International

Visitor Arrivals

3. Singapore Tourism Board, Tourism Sector

Performance for Quarter 4 of 2014, 20 May 2015

4. Singapore Tourism Board, SIA, CAG and STB

strengthen commitment to tourism with largest

partnership to date, 30 June 2015

5. Ministry of Trade and Industry Singapore,

Speech by Mr S Iswaran at the Tourism Industry

Conference 2015, 7 April 2015

6. CBRE Market View Singapore, 2Q 2015

7. Knight Frank Retail Bulletin, 1Q 2015

8. CBRE, How Global is the Business of Retail, 2015

9. Department of Statistics Singapore, Retail

Sales Index, Food & Beverage Services Index,

14 August 2015

10. Australia Bureau of Statistics

11. Colliers International, Research and Forecast

Report, First Half 2015, Australia and New Zealand

12. CBRE Viewpoint, Adelaide Property Market:

What Does the Future Hold?, June 2015

13. Homewares Giant Pottery Barn Moves to Perth,

The West Australian, 16 July 2015

14. Department of Statistics, Malaysia

15. The Star, Weakening Ringgit, Politics Affecting

Retail Sector; Prices May Rise, 11 August 2015

16. Tourism Malaysia

17. The Star, Nazri Stands By Belief That Weak Ringgit

Is Good For Tourism, 7 August 2015

18. Knight Frank Real Estate Highlights, Malaysia,

1st Half 2015

19. National Bureau of Statistics of China

20. Chengdu Bureau of Statistics

21. CBRE, Chengdu Property Market Overview 2Q 2015

22. Japan Cabinet Office

23. Bank of Japan, Monthly Report of Recent Economic

and Financial Developments, July 2015

24. CBRE, Japan Retail Market View, 2Q 2015

sentiment. Based on preliminary readings,

GDP growth eased to 7.0% in 1H 2015 from

7.4% in FY 2014

(19)

owing to macroeconomic

factors and downward pressure of domestic

economic development. Mirroring the slowdown,

nationwide retail sales growth in 1H 2015 eased

to 10.3%, compared to 12.4% in 1H 2014

(19)

. In

Chengdu, retail sales growth have also eased to

10.9% in 1H 2015, compared to 13.6% in 1H 2014

(20)

as the ongoing anti-corruption and austerity

drive continue to impact the high-end luxury

market. Chengdu’s retail landscape continues to

be challenged with high future supply pipeline

with 1.8 million square metres of space expected

by 2016

(21)

.

JAPAN RETAIL PROPERTY MARKET

According to preliminary estimates, Japan’s

GDP declined at an annualised 1.6% for the

second quarter of 2015 after posting growth

for the previous two quarters, due to weaker

consumption and slow exports

(22)

. In July 2015,

the Bank of Japan trimmed its forecast for

growth in the current fiscal year to March 2016

from 2.0% to 1.7% but kept its current monetary

policy unchanged, as it maintained that the

economy would continue to grow moderately

for the current fiscal year

(23)

. Retail sales in

Japan rose 0.9% yoy in June 2015, following

a 3% and 5% gain in May and April 2015

respectively

(22)

. Competition for retail space

along the main streets remains tight as a wide

variety of retailers including luxury, fast fashion

and sportswear brands continue to adopt a

positive attitude towards expansion

(24)

.

Financial

Review

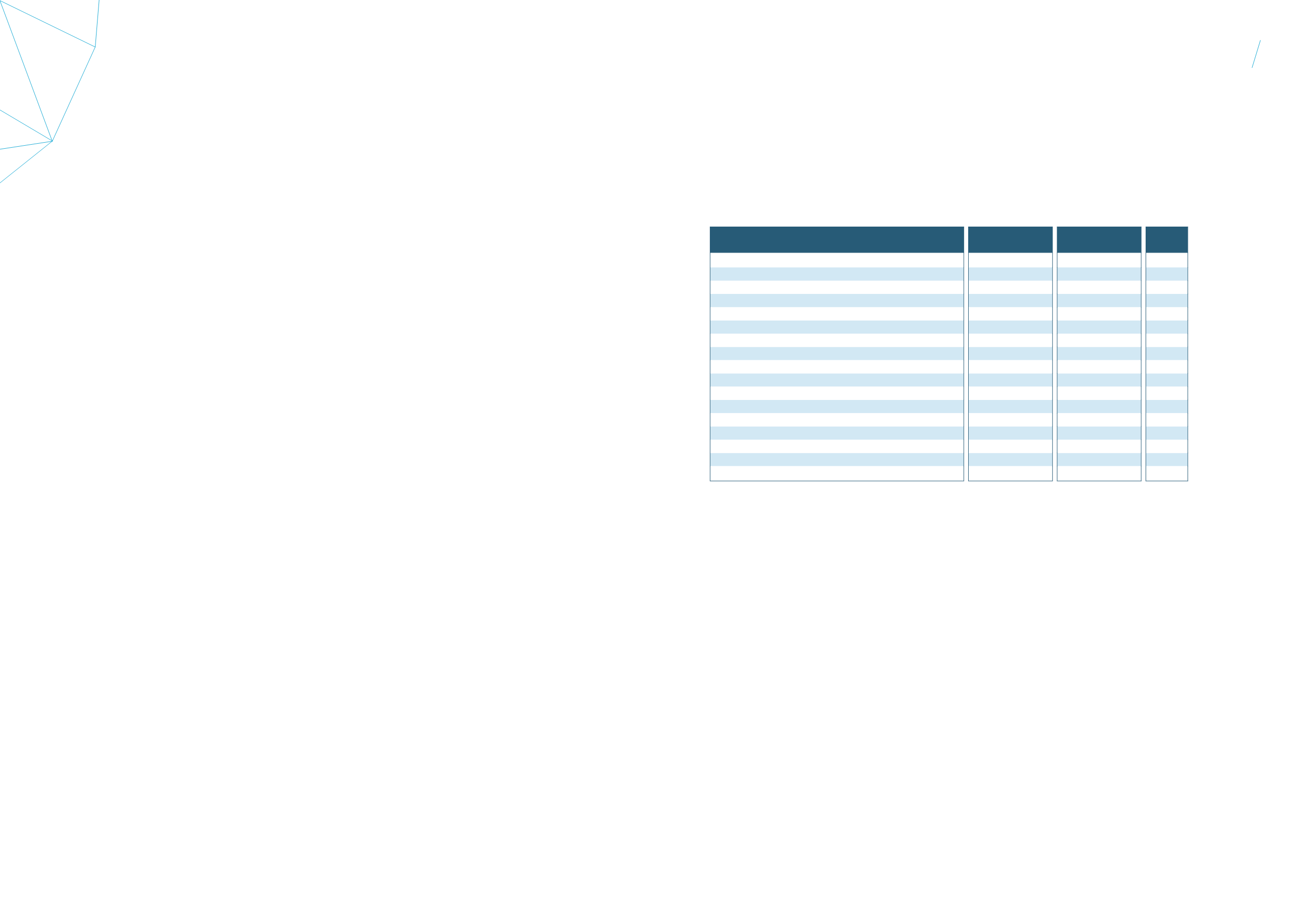

FINANCIAL REVIEW – FY 2014/15 (18 MONTHS) VERSUS FY 2013 (12 MONTHS)

Due to the change in Starhill Global REIT’s financial year end from December to June, which resulted in a longer 18-month

period from January 2014 to June 2015 for FY 2014/15 compared to a 12-month period from January 2013 to December 2013

for FY 2013, the figures presented below are not directly comparable.

Group

FY 2014/15

(S$’000)

FY 2013

(S$’000)

Change

(%)

Gross revenue

294,789

200,616

46.9%

Property expenses

(57,160)

(42,760)

33.7%

Net property income

237,629

157,856

50.5%

Non property expenses

(72,288)

(47,188)

53.2%

Net income before tax

165,341

110,668

49.4%

Change in fair value of derivative instruments

(479)

4,643

NM

Change in fair value of investment properties

9,120

137,528 (93.4%)

Total return for the period before tax and distribution

173,982

252,839 (31.2%)

Income tax

559

(2,861)

NM

Total return for the period after tax, before distribution

174,541

249,978 (30.2%)

Non-tax (chargeable)/deductible items

(2,965)

(139,125)

(97.9%)

Income available for distribution

171,576

110,853

54.8%

Income to be distributed to:

– Unitholders

164,007

104,781

56.5%

– CPU holder(s)

1,287

3,056 (57.9%)

Total income to be distributed

165,294

107,837

53.3%

Distribution per Unit

7.60 cents

5.00 cents

52.0%

Gross revenue of S$294.8 million for FY 2014/15 was 46.9%

higher than S$200.6 million achieved in FY 2013, mainly

due to the additional six months in FY 2014/15, as well as

stronger performance of Singapore Properties and Australia

Properties following the acquisition of Myer Centre Adelaide

in May 2015. The increase was partially offset by one-time

receipt of accumulated rental arrears in 1Q FY 2013 from

the master tenant Toshin at Ngee Ann City Property for

the period June 2011 to December 2012, as well as lower

contribution from Renhe Spring Zongbei Property and weaker

foreign currencies. NPI for the Group increased by 50.5% to

S$237.6 million for FY 2014/15.

Singapore, Malaysia and Australia are our three largest

contributors to NPI, accounting for 94.7% of the Group’s

NPI for FY 2014/15.

Non property expenses were S$72.3 million for FY 2014/15,

53.2% higher than in FY 2013, mainly attributed to the

additional six months in FY 2014/15.

The income tax credit for FY 2014/15 was mainly attributed

to the deferred tax reversal arising from downward property

revaluation of Renhe Spring Zongbei Property.

The loss on derivative instruments for FY 2014/15 represents

mainly the change in the fair value of interest rate swaps

and caps entered into for the Group’s borrowings. The change

in fair value on investment properties of S$9.1 million for

FY 2014/15 represented the net revaluation gain on the

Group’s investment properties.

Income available for distribution and income to be distributed

to the Unitholders and holder of CPU for FY 2014/15 was

S$171.6 million and S$165.3 million respectively. Total DPU for

FY 2014/15 was 7.60 cents.

59

58

STARHILL

GLOBAL

REIT

Annual

Report

FY 2014/15