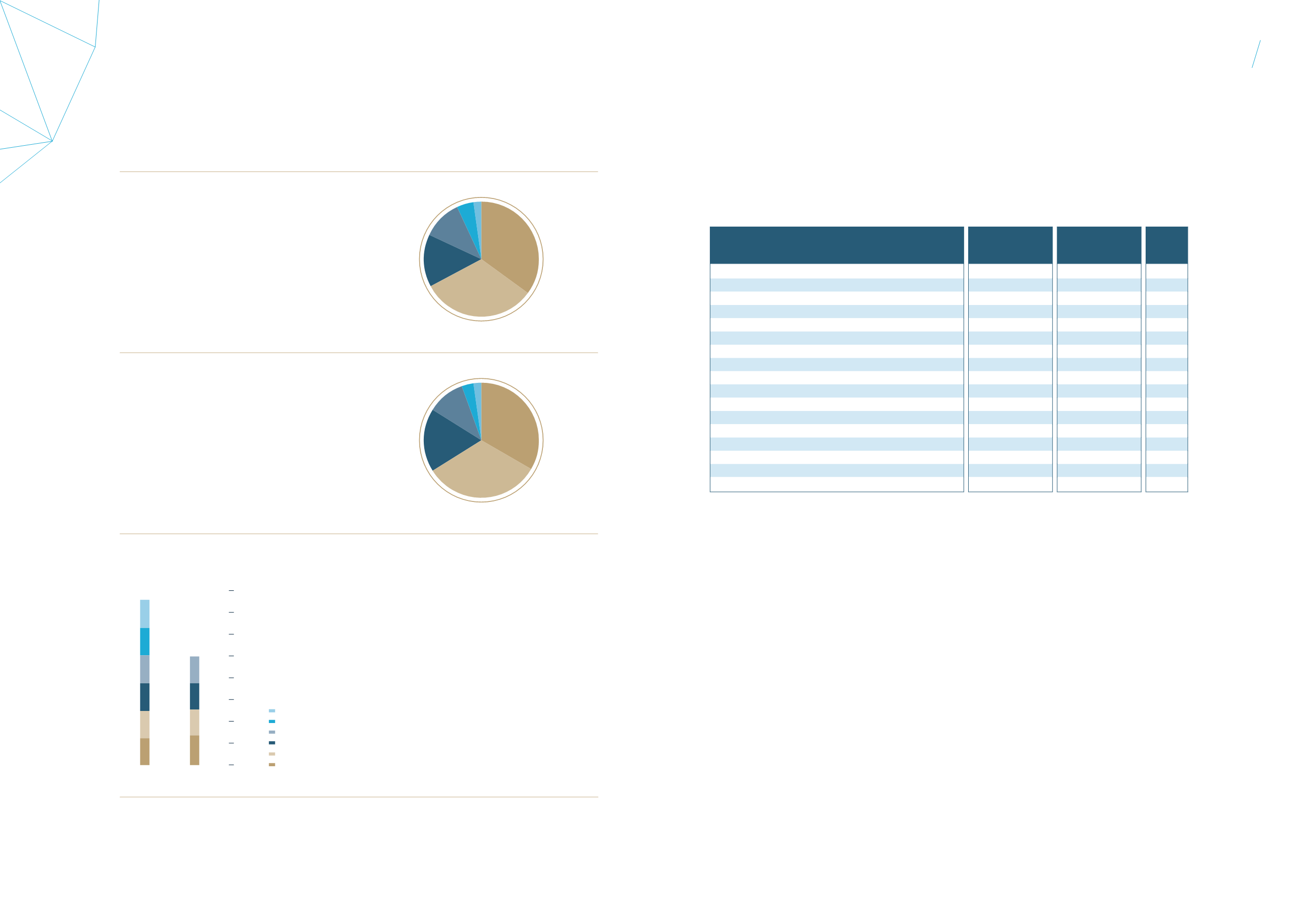

S$ million

%

1

Wisma Atria Property

79.7 33.6

2 Ngee Ann City Property

77.8 32.7

3 Malaysia Properties

42.2 17.8

4 Australia Properties

(1)

25.1 10.6

5 Renhe Spring Zongbei Property

7.5

3.1

6 Japan Properties

5.3

2.2

NET PROPERTY INCOME

FY 2014/15 (18 months)

1

3

5 6

4

2

Financial

Review

FINANCIAL REVIEW – JULY 2014 TO JUNE 2015 (12 MONTHS) VERSUS JULY 2013 TO JUNE 2014 (12 MONTHS)

For the purposes of providing a 12-month yoy analysis of Starhill Global REIT’s financial performance, the figures for the

12-month period from 1 July 2014 to 30 June 2015 (“current 12-month period”) and the corresponding 12-month period from

1 July 2013 to 30 June 2014 (“corresponding 12-month period”) are presented below:

Group

July 2014 –

June 2015

(S$’000)

July 2013 -

June 2014

(S$’000)

Change

(%)

Gross revenue

197,152

195,491

0.8%

Property expenses

(37,785)

(40,384)

(6.4%)

Net property income

159,367

155,107

2.7%

Non property expenses

(48,984)

(46,935)

4.4%

Net income before tax

110,383

108,172

2.0%

Change in fair value of derivative instruments

2,145

(4,152)

NM

Change in fair value of investment properties

9,120

137,528

(93.4%)

Total return for the period before tax and distribution

121,648

241,548

(49.6%)

Income tax

2,077

(2,239)

NM

Total return for the period after tax, before distribution

123,725

239,309

(48.3%)

Non-tax (chargeable)/deductible items

(8,265)

(128,881)

(93.6%)

Income available for distribution

115,460

110,428

4.6%

Income to be distributed to:

- Unitholders

110,392

106,154

4.0%

- CPU holder(s)

770

1,042

(26.1%)

Total income to be distributed

111,162

107,196

3.7%

Distribution per Unit

5.11 cents

4.93 cents

3.7%

Gross revenue for the current 12-month period was

S$197.2 million, an increase of S$1.7 million or 0.8% over

the corresponding 12-month period, mainly due to stronger

performance of Singapore Properties and higher contribution

from Australia Properties following the acquisition of Myer

Centre Adelaide in May 2015. The increase was partially offset

by lower contribution from Renhe Spring Zongbei Property

and weaker foreign currencies. NPI grew by S$4.3 million

or 2.7% over the corresponding 12-month period to reach

S$159.4 million for the current 12-month period, mainly in line

with the higher gross revenue and lower property expenses

of the Group.

Singapore Properties contributed 67.4% of total revenue or

S$132.9 million for the current 12-month period, 2.4% higher

than the corresponding 12-month period. NPI increased

by 3.9% to S$106.0 million, primarily due to positive rent

reversions and lower operating expenses.

Malaysia Properties contributed 14.7% of total revenue or

S$29.0 million in the current 12-month period, 2.2% lower

than the corresponding 12-month period. NPI for the current

12-month period of S$28.2 million was a 0.9% drop from

the corresponding 12-month period, mainly due to the

depreciation of RM.

Australia Properties contributed 11.5% of total revenue or

S$22.6 million in the current 12-month period, 17.5% higher

than the corresponding 12-month period. NPI for the current

12-month period was S$17.6 million, 17.6% higher than the

corresponding 12-month period, mainly due to contribution

from newly acquired Myer Centre Adelaide from May 2015

and positive rent reversion on the leases for David Jones

Building (including the rent review for David Jones lease

from August 2014). The increase was partially offset by

depreciation of A$.

Renhe Spring Zongbei Property in Chengdu, China,

contributed 4.3% of total revenue or S$8.5 million in the

current 12-month period, 26.9% lower than the corresponding

12-month period. NPI for the current 12-month period was

S$4.3 million, 34.8% lower than the corresponding 12-month

period, largely due to lower revenue amidst contraction of

the high-end and luxury retail segment resulting from the

government austerity drive and increased competition from

new and upcoming retail developments in the city.

Japan Properties contributed 2.1% of total revenue or

S$4.2 million in the current 12-month period, 20.1% lower

than the corresponding 12-month period. NPI for the current

12-month period was S$3.3 million, 7.1% higher than the

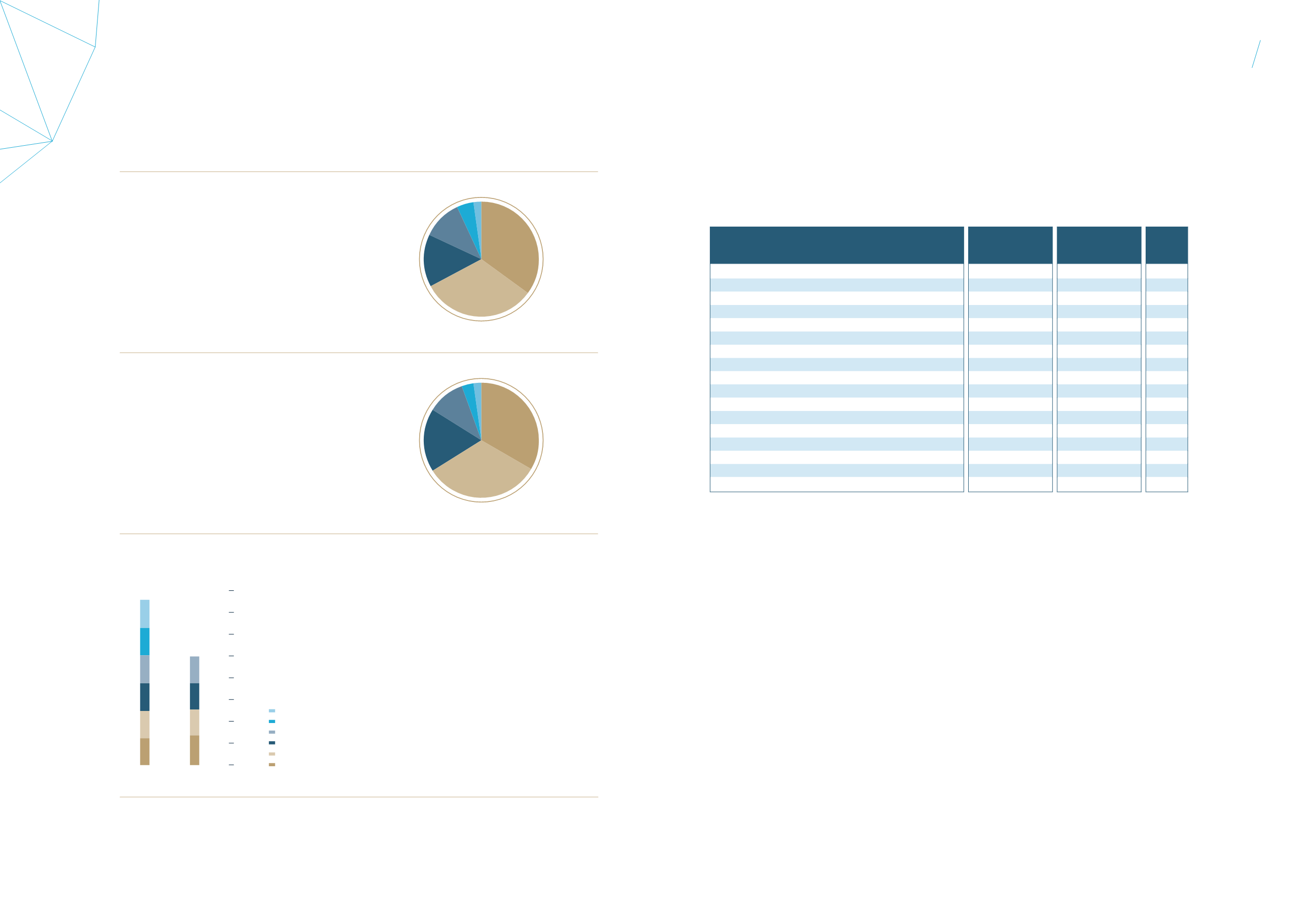

S$ million

%

1

Wisma Atria Property

103.5 35.1

2 Ngee Ann City Property

94.8 32.2

3 Malaysia Properties

43.8 14.8

4 Australia Properties

(1)

32.4 11.0

5 Renhe Spring Zongbei Property

13.8

4.7

6 Japan Properties

6.6

2.2

1

5 6

4

3

2

GROSS REVENUE

FY 2014/15 (18 months)

5.00

(2) (3)

FY 2014/15 FY 2013

8.0

7.0

6.0

5.0

4.0

3.0

2.0

1.0

0.0

FY 2014/15

FY 2013

6Q

1.29

(1)

NA

5Q

1.26

NA

4Q

1.29

1.23

3Q

1.27

1.21

2Q

1.25

1.19

1Q

1.24

1.37

(2)

7.60

(1) (3)

Notes:

(1)

Included contribution from the newly acquired

Myer Centre Adelaide from May 2015.

(2)

Included one-time DPU payout of 0.19 cents due

to receipt of accumulated rental arrears from

Toshin master lease (net of expenses).

(3)

The computation of DPU for FY 2014/15 is based

on the number of units entitled to distributions

comprising 2,153,218,267 units in issue for

1Q to 5Q FY 2014/15 and the number of units

post-CPU conversion on 25 June 2015 of

2,181,204,435 units for 6Q FY 2014/15. The

computation of DPU for FY 2013 is based on

the number of units entitled to distributions

comprising 1,943,023,078 units in issue for

1Q FY 2013 and the number of units post-CPU

conversion on 5 July 2013 of 2,153,218,267 units

for 2Q to 4Q FY 2013.

DISTRIBUTION PER UNIT

(cents)

61

60

STARHILL

GLOBAL

REIT

Annual

Report

FY 2014/15