corresponding 12-month period, mainly due to reversal of

rental arrears provision in the current 12-month period.

The increase was partially offset by depreciation of JPY and

loss of income contribution following the divestment of

Holon L in March 2014.

Non property expenses for the current 12-month period

were S$49.0 million, a S$2.0 million or 4.4% increase over

the corresponding 12-month period. This was mainly due to

higher finance expenses and management fees in the

current 12-month period.

Finance expenses for the current 12-month period were

S$31.7 million, a S$1.5 million or 4.9% increase over the

corresponding 12-month period. This was mainly due to

additional interest costs incurred for the A$145 million

loan and the S$125 million MTN drawn/issued in May 2015,

full period of interest cost from the S$100 million MTN

issued in February 2014, as well as amortisation of the

remaining capitalised borrowing costs for the early

refinancing of JPY6.3 billion and S$100 million term loans,

and RM330 million MTN. The increase was partially offset

by lower interest costs incurred on the existing foreign

currency borrowings.

Management fees for the current 12-month period were

S$15.0 million, a S$0.5 million or 3.6% increase over the

corresponding 12-month period. The increase was in line

with the higher average value of trust property during the

current 12-month period.

Trust expenses for the current 12-month period were

S$3.0 million, a S$0.1 million or 2.0% drop from the

corresponding 12-month period. The S$0.4 million gain on

divestment in the corresponding 12-month period represented

the difference between the net proceeds and the carrying

amount of Holon L divested in March 2014.

Income tax credit for the current 12-month period was

S$2.1 million as compared to income tax expenses of

S$2.2 million in the corresponding 12-month period. This was

mainly attributed to the deferred tax reversal arising from

downward property revaluation of Renhe Spring Zongbei

Property, lower net income of Renhe Spring Zongbei Property

for the current 12-month period, as well as lower withholding

tax provision for Renhe Spring Zongbei Property and the

Japan Properties. The variance was partially offset by higher

withholding tax provision for the Australia Properties.

The change in fair value of derivative instruments of

S$2.1 million for the current 12-month period represented

mainly fair value gain on interest rate swaps and caps for the

Group’s borrowings. The change in fair value on investment

properties of S$9.1 million for the current 12-month period

represented the net revaluation gain on the Group’s

investment properties.

Financial

Review

Income available for distribution for the current 12-month

period was S$115.5 million, an increase of S$5.0 million or

4.6% over the corresponding 12-month period. Income to

be distributed to the Unitholders and holder of CPU for the

current 12-month period was S$111.2 million, an increase of

S$4.0 million or 3.7% over the corresponding 12-month period.

Total DPU for the current 12-month period from 1 July 2014

to 30 June 2015 was 5.11 cents, representing an increase of

3.7% over DPU of 4.93 cents achieved for the corresponding

12-month period from 1 July 2013 to 30 June 2014.

ASSETS AND LIABILITIES

The Group’s total assets as at 30 June 2015 were

S$3,193.4 million, representing an increase of S$250.2 million

or 8.5% compared to S$2,943.2 million as at 31 December

2013, mainly due to the newly acquired Myer Centre Adelaide

in May 2015. The Group’s portfolio of 13 prime properties

across five countries was independently revalued at

approximately S$3,116.2 million as at 30 June 2015, recording

a net revaluation gain of S$9.1 million for FY 2014/15. The

geographic breakdown of the portfolio by asset value as

at 30 June 2015 was as follows: Singapore 66.5%, Australia

16.1%, Malaysia 12.7%, Japan 2.6% and China 2.1%.

The Group’s total liabilities as at 30 June 2015 were

S$1,210.6 million, representing an increase of S$277.6 million

or 29.8%, compared to S$933.0 million as at 31 December

2013, mainly in line with the additional borrowings drawn

to fund the Myer Centre Adelaide acquisition. Gearing

increased from 29.0% as at 31 December 2013 to 35.5%

as at 30 June 2015.

The Group’s net asset value remained largely stable at

S$1,982.8 million (NAV per Unit of S$0.91) as at 30 June 2015,

compared to S$2,010.1 million (NAV per Unit of S$0.93) as

at 31 December 2013.

CASH FLOW

Total net cash outflow (excluding effects of exchange

rate differences) for FY 2014/15 was S$3.7 million, largely

comprising cash outflow from investing activities of

S$315.8 million, partially offset by net cash flows from

operating activities of S$212.4 million and cash inflow from

financing activities of S$99.8 million. The cash outflow

from investing activities related mainly to the purchase of

Myer Centre Adelaide in May 2015. Cash flows from financing

activities comprised mainly proceeds from borrowings,

partially offset by repayment of borrowings and distributions

paid to Unitholders.

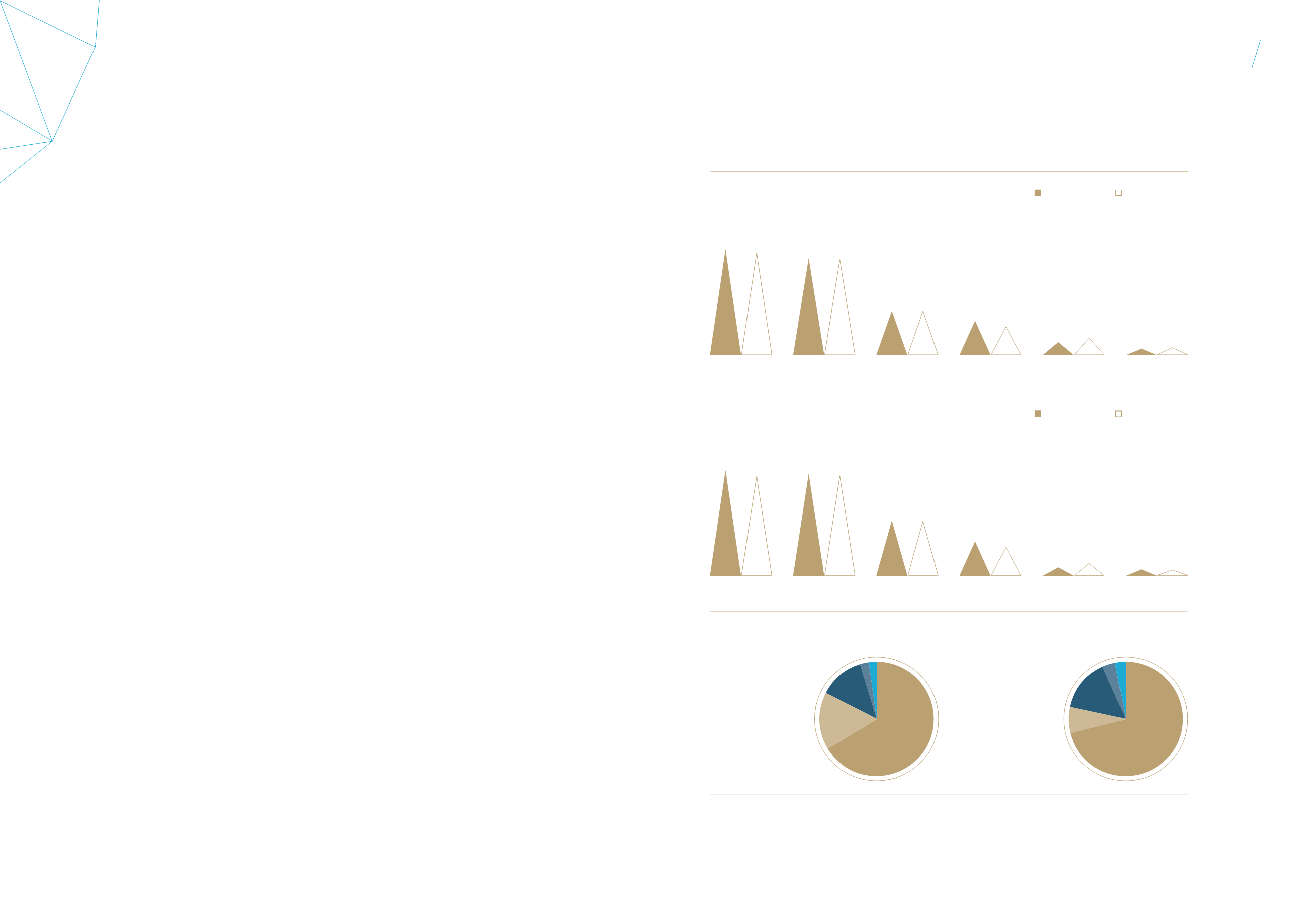

GROSS REVENUE

(S$ million)

% contributed by:

12 months from

Jul 14 – Jun 15

12 months from

Jul 13 – Jun 14

Wisma Atria Property

35.2%

34.4%

Ngee Ann City Property

32.2%

32.0%

Malaysia Properties

14.7%

15.2%

Australia Properties

11.5%

9.8%

Renhe Spring Zongbei Property

4.3%

5.9%

Japan Properties

2.1%

2.7%

69.4

67.2

63.5

62.6

29.0

29.6

22.6

19.3

8.5

11.6

4.2

5.2

Wisma Atria

Property

Ngee Ann City

Property

Malaysia

Properties

Renhe Spring

Zongbei Property

Australia

Properties

Japan

Properties

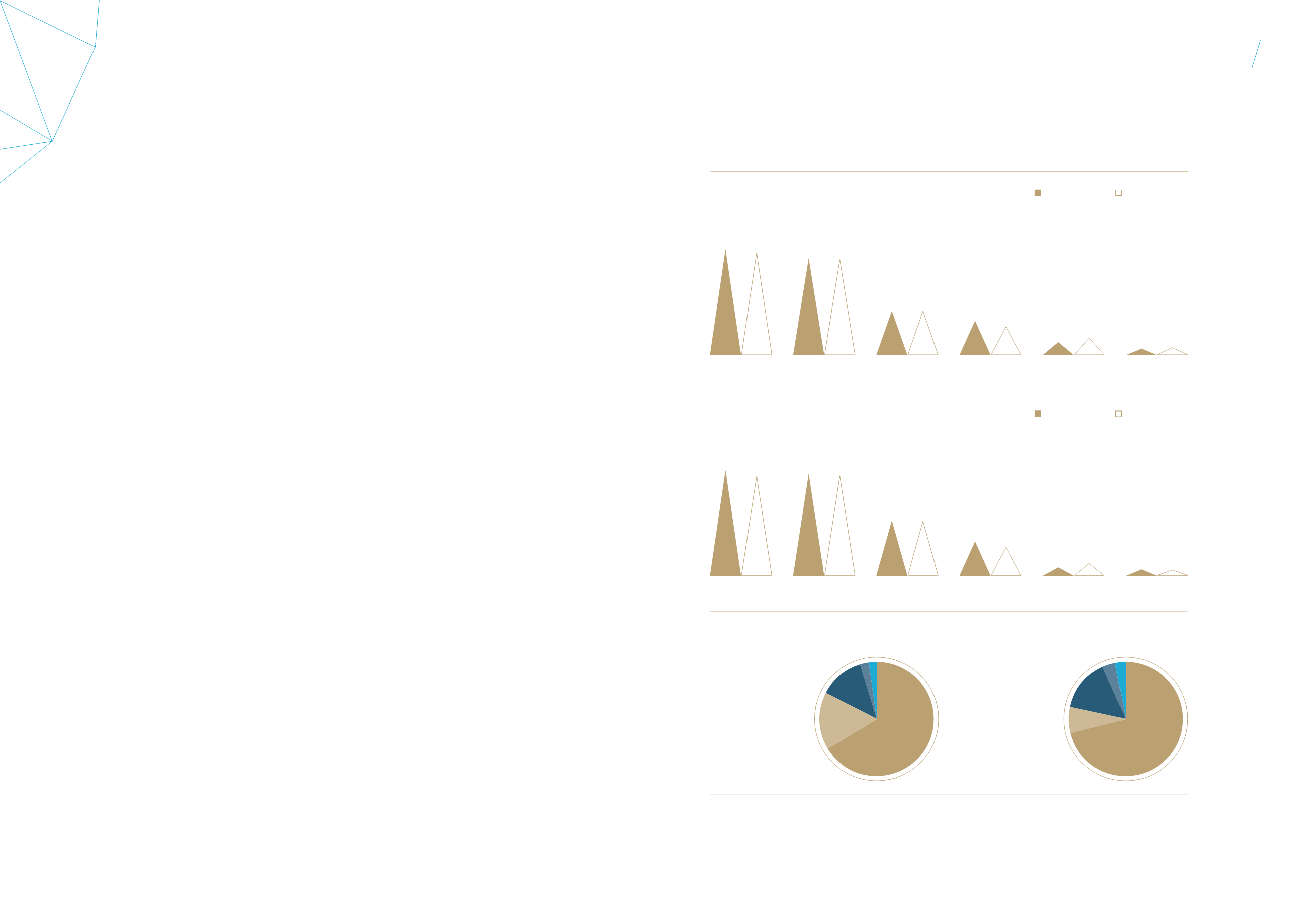

ASSET VALUE BY COUNTRY

As at 30 Jun 2015

1 Singapore

66.5%

2 Australia

16.1%

3 Malaysia

12.7%

4 Japan

2.6%

5 China

2.1%

1

54

3

2

As at 31 Dec 2013

1 Singapore

71.3%

2 Australia

7.3%

3 Malaysia

15.0%

4 Japan

3.5%

5 China

2.9%

1

54

3

2

NET PROPERTY INCOME

(S$ million)

% contributed by:

12 months from

Jul 14 – Jun 15

12 months from

Jul 13 – Jun 14

Wisma Atria Property

33.8%

32.8%

Ngee Ann City Property

32.7%

33.0%

Malaysia Properties

17.7%

18.3%

Australia Properties

11.0%

9.6%

Renhe Spring Zongbei Property

2.7%

4.3%

Japan Properties

2.1%

2.0%

53.9

50.9

52.1

51.1

28.2

28.5

17.6

14.9

4.3

6.6

3.3

3.1

Wisma Atria

Property

Ngee Ann City

Property

Malaysia

Properties

Renhe Spring

Zongbei Property

Australia

Properties

Japan

Properties

63

62

STARHILL

GLOBAL

REIT

Annual

Report

FY 2014/15